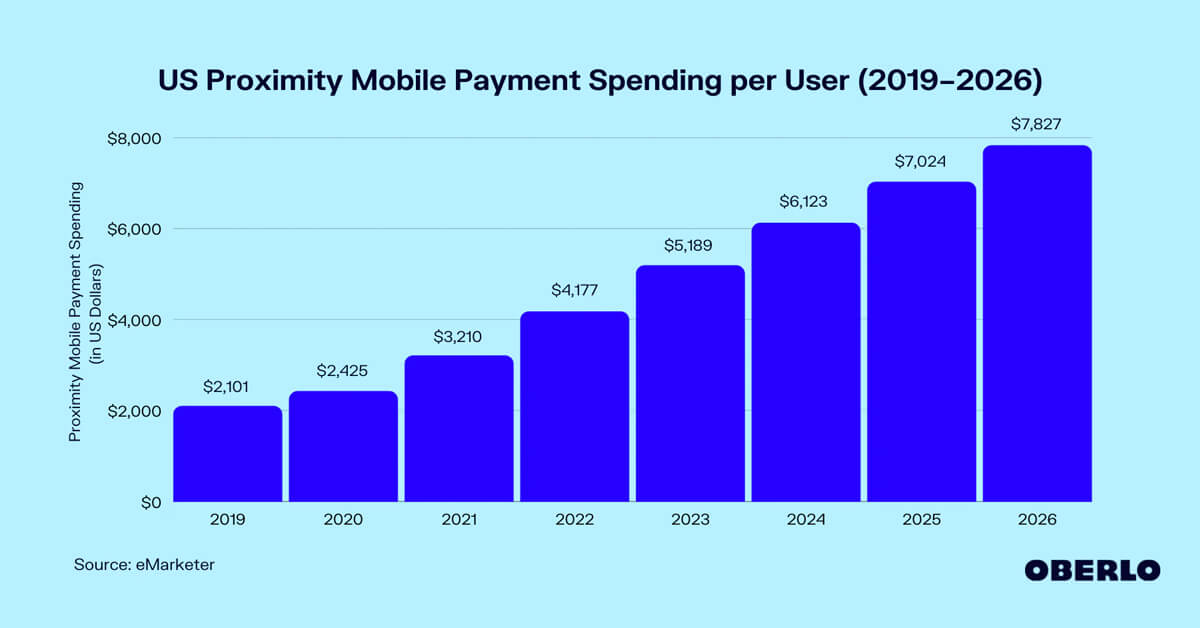

With increasing smartphone usage for restaurants, shopping, traveling, clinical appointments, salon bookings, on-demand services, food ordering, grocery delivery, and a lot more, mobile payment spending has skyrocketed like never before. The latest pandemic fueled mobile payments globally. Mobile payment is one of the important mobile app features that cannot be ignored at all.

The massive shift has mandated mobile app development with built-in payment gateways. Enabling mobile payments posed certain challenges around security, compliance, user experience, and churning rates. The payment gateway has the answers to all the roadblocks. In addition to addressing pain points, payment gateway integration into the mobile app makes it easier for customers to make payments without the hassle of providing information repetitively.

The improved buying experiences with payment gateway integration generate repeat business and thus, more ROI. Besides, the controlled payment experiences in sync with the industry improve the branding as well. Thereby mobile payment gateway integration is increasing and expecting the same growth in the years to come. If you want to Integrate payment gateways in your existing app or want to build a new app with payment gateway integration, partner with a mobile app development company to enjoy the gala benefits of integrating payment gateway solutions.

Let’s understand payment gateways, the features that payment gateways must have, tips to choose the right payment gateway, and the payment gateway integration process.

Table of Contents

What is a Payment Gateway?

The direct interaction between the app and payment processor when customers perform a transaction is never secure. That’s where payment gateway service providers serve as a mediator which allows web and mobile apps to perform transactions safely.

The payment gateway solutions leverage encryption techniques to secure data processing that ultimately makes digital payment secure. Third-party payment gateways are the best alternatives for businesses that don’t want to bear the responsibility of sensitive data security and stay assured that data remains safe. Going ahead with custom app development helps you get to build an app with mobile payment gateway integration followed by a range of benefits in the same vein.

Take a look at online payment processing with payment gateway integration.

- Card information is sent to payment gateways.

- The payment gateway forwards the information to the concerned bank.

- Bank forwards the payment processing requests to the payment system after checking the money in the cardholder’s account.

- The payment system analyzes the transaction and completes payment through an authorization code provided by the bank.

- The payment gateway receives the code and money is transferred to the seller’s account once the transaction is approved by the bank.

What are the Features to look for in Payment Gateways?

When the enormous benefits of payment gateway integration appeal to you, implementing a third-party payment gateway makes perfect sense. However, it requires the selection of the right payment gateway that meets the app’s payment processing needs and also caters to the user’s requirement for online payment from their preferred channel.

Payment gateway hosting

Payment gateway hosting type creates a lot of differences in acquiring and retaining customers followed by traffic handling.

The payment gateway hosting is done in two ways- hosted off-site and integrated payment gateway.

Hosted off-site payment gateway involves taking the customers to other sites to complete the transactions which make tracking conversions difficult.

Integrated payment gateway involves payment gateway integration with an app through payment gateway API, which delivers an amazing user experience in a single click. This type of payment gateway hosting makes the conversion rate better as retaining customers’ data such as credit card number, debit card number, and UPI account connection doesn’t require the user to repetitively enter the financial information again and again.

Merchant account selection

The payment gateway setup mandates a merchant account set up for enabling the processing of online payment methods such as credit and debit through a selected payment gateway. Merchant accounts are of two types- dedicated and aggregator that payment gateway service providers should support.

A dedicated merchant account is used by only one business which improves control over transactions. An aggregate merchant account involves account sharing by different businesses that are easier to set up with no regulations required to create for handling funds.

Payment gateway APIs

Often, payment gateway integration with mobile apps is enabled with payment gateway APIs. It helps businesses easily track conversions and control user experiences because payment processing gateway APIs facilitate payment gateway customization while integrating with app features. On the contrary, some payment gateway provides third-party APIs that give least to no insights into customer payment.

Security certificate

The topmost concern that deters users from mobile payment is secure. For payment gateway integration, you need to make sure the payment processing gateway must fulfill the latest security standard, that’s PCI DSS for storing the customers’ credit card data. The trusted payment gateway should have security measures such as encryption, tokenization, and SSL certificate for fraud prevention. Attention to detail ensures customer detail remains safe and diminishes chargebacks.

Customer support

When partnering with online payment gateway service providers, make sure that they provide good customer support services to resolve queries in the least time. It keeps businesses in a good position when something goes wrong while dealing with payment.

Support for multi-currency

When your business sells products or services cross-borders, you need to accept the payment in different currencies supported by distinct geographic nations. Make sure the payment gateway supports a multi-currency feature so that transactions through the mobile app can be done by global customers seamlessly.

Scalability

When your business grows, the possibility of increasing the number of transactions is quite expected. Here, you need to check if the payment gateway supports scalability or not. The online payment gateway should be capable of handling an increasing number of transactions without much ado. Migrating to another payment gateway service provider would bring technical issues that are quite frustrating to handle.

Recurring billing

Some businesses provide products or services that require charging from customers regularly. It requires an online payment processing system to enable a recurring billing option and not all the payment gateway service providers facilitate the same. Therefore, you should check if the payment processing platform provides the service or not.

Dispute management

With online payment processing, disputes are quite common that need to manage intelligently. Else, businesses lose customers to the competition. For instance, the merchant processed the refund but users don’t get the same, which creates disputes between two parties. The payment gateway with a dispute management system helps businesses handle the incidents fairly and convince frustrated customers nicely.

Top Payment Gateway Service Providers

The overview of payment gateways and their features helps businesses know how to select the right payment gateway provider. Here’s the list of the most popular payment gateway service providers that you can trust and get an integrated payment gateway.

- PayPal

- Braintree

- Dwolla

- Amazon payments

- Stripe

- Authorize.net

- Skrill

- Network International

- Adyen

- Helcim

- Square

How to Choose the Right Payment Gateway?

With a list of popular payment gateway service providers ready, you need to consider a few things for making an ideal selection. The things to keep in mind-

Figure out payment gateway needs

Understanding business needs for online transactions for money before payment gateway integration is all-important to making the right choice. For instance, you should know the type of business, things to sell- content or material, recurring billing needs, support for multi-currency required or not, and frameworks required for payment gateway integration. A clear view of the need for payment gateways helps in comparing and coming up with the right choice.

Identify payment gateway integration cost

The integration of the payment gateway system doesn’t come for free. Businesses should look at payment gateway fee structure. The charges of payment gateways are different for setup, per transaction, and associated annual or monthly subscription charges. Compare the individual and total cost of the payment gateway service provider to select the one that is not too costly.

Gain insights into user experiences

The payment system integration is done to deliver a seamless checkout experience to the users and increase the conversion rate. Besides, managing payment and tracking conversion would be easier. Evaluate which payment gateway helps in delivering the best user experience.

How to Integrate a Third-party Payment Gateway with a Mobile Application?

The third-party payment gateway integration process varies from one provider to another. However, the basic steps remain the same for Android and iOS apps, and a few tweaks are best guided by the payment gateway service provider. The steps answer the questions that most of the clients ask- how to integrate a payment gateway in an application.

Merchant account setup

Creating a merchant account with a payment processor is essential that enables credit/debit card transaction processing. Also, make sure the company of the payment gateway provider and payment processor should be the same so that everything can be managed centrally.

Account setup with a payment gateway provider

As discussed above the company of the payment gateway provider and payment processor should be preferably the same. However, account creation with a payment gateway solution provider is also necessary. Enter the detail of the account and link it with the merchant account.

Gain API credentials

Payment gateway API communicates with the app during every transaction processing. Before start using payment gateway services, getting payment gateway API credentials from the service provider is vital. Test account creation is favorable to avoid conflicts or issues with accurate payment processing.

Payment gateway configuration

It’s time to configure a payment gateway that involves specifying the payment types that are accepted such as credit cards, debit cards, NFC, mobile wallets, and others.

Payment gateway integration with mobile app

Finally, the payment gateway service provider shares the code snippets to start with payment gateway integration followed by extensive documentation. The code implementation enables seamless handling of transaction data to the payment gateway provider and receiving back the required data. The code implementation process remains nearly the same for both Android and iOS applications, but the difference lies only in the programming languages used. The process to integrate an online payment gateway in Android and iOS looks like this-

Card acceptance with drop-in UI

Drop-in UI is a code snippet that’s provided by a payment gateway service provider, which needs to be embedded in the mobile app’s code.

Client token generation

For drop-in UI initialization, a client token, which is an identifier is required. Client token is generated by the server and sent to the app whenever a new app is launched.

Integration testing

When payment gateway integration is completed, it’s vital to check the payment gateway is performing as expected so that it won’t interfere with user experiences.

Mobile app launch with payment gateway integration

When everything is ready, it’s time to launch the mobile app with an integrated payment gateway. Users can use the implemented payment gateway for payment and more as per the app.

Are you prepared to Implement a Payment Gateway with your Mobile app?

The payment gateway integration with mobile apps is the future that users expect the least. So, it makes perfect sense to integrate it with the mobile application. Presently, payment gateway service providers offer a complete suite of tools that makes integration of payment gateway seamless. Get your mobile payment processing, in-store payment processing, and online payment processing needs covered by selecting and partnering with the right payment service provider.

If you are a little unsure about payment gateway integration, consult the top mobile app development company. They can help you with the required selection and with the necessary integration process. Also, they assist you with expected time and cost estimation according to your mobile business app needs.

Frequently Asked Questions about Payment Gateway Integration

How do I integrate a payment gateway on my mobile app?

The payment gateway service providers offer SDK that facilitates developers to integrate payment gateway in the least time and effort because SDK includes the set of libraries required for integration. SDKs help with payment form creation to gather users’ data.

Can I use a third-party payment gateway on the iOS app?

Yes, special SDKs are provided by payment gateway service providers for seamless implementation on iOS apps. It makes using a third-party payment gateway for iOS apps possible.

How does the payment gateway work in the mobile app?

The payment gateway provides a payment gateway API that enables integration with the mobile app and facilitates communication with the payment platform. The API encrypts the card’s data, handles payment request authorization, and confirms mobile payment.

Avantika Shergil

| Mar 28, 2023

Avantika Shergil

| Mar 28, 2023

Avantika Shergil is a technology enthusiast and thought leader with deep expertise in software development and web technologies. With over 8 years of experience analyzing and evaluating cutting-edge digital solutions, Avantika has a knack for demystifying complex tech trends. Her insights into modern programming frameworks, system architecture, and web innovation have empowered businesses to make informed decisions in the ever-evolving tech landscape. Avantika is passionate about bridging the gap between technology and business strategy, helping businesses build customized software and website, and understand about different tools to leverage effectively for their ventures. Explore her work for a unique perspective on the future of digital innovation.