With the advent of cutting-edge technologies, businesses are also moving towards digitization. Having a mobile app for the insurance agency is a great advantage to the customers. Insurance companies are also developing an impactful application due to the high market and customer demand.

No matter what type of insurance policies a client chooses when it is available via smart mobile application nothing can be much more convenient than this. Various fintech app developers are providing the best insurance mobile app development services at a reasonable price. Well, here in this write-up, a step-by-step insurance app development guide is provided in detail.

Table of Contents

- Benefits of the Insurance Mobile Application for Business

- How does the Insurance App Work?

- Types of Insurance App

- Insurance App Monetization

- Best Features of the Insurance Mobile App

- Top 10 Insurance Apps

- Tech Stack used for Insurance App Development

- Steps to Develop an Insurance App

- Advanced Technology in the Insurance App

- Cost to Develop an Insurance App

- It’s all about playing safe!

Benefits of the Insurance Mobile Application for Business

Insurance mobile application development is making insurance policy information accessible, claim settlement easier, and account management a breeze for customers. In the same vein, opening a mobile window (insurance app development) is beneficial to insurance businesses in different ways, which you can dig deeper into in this section.

Increased Efficiency

Enhanced Efficiency with mobile insurance apps are a game-changer, enabling swift claim initiation and processing with easy document submission. This not only reduces claim processing time and effort but also automates policy management without human intervention. The result? A significant boost in efficiency, saving time and money that can be invested in core business activities.

Greater Data Insights

Top insurance apps allow insurers to tap into customers’ data with mobile analytics functionality that reveals rich insights essential to making data-driven decisions. The analytics engine collects customers’ identity data, transactional data, financial data, and behavioral data that helps insurers understand customers’ preferences and interests required to make informed decisions regarding policies, services, and others.

Improved Customer Experience

Insurance apps enable real-time communications between insurers and insured that ensure customers get timely updates for policy information, claim settlement, and other important alerts. Personalized notifications build trust, encourage transparency, increase loyalty, nurture strong relationships, and deliver the best customer experience, which ultimately results in higher conversion.

Making Money

Insurance applications reduce operational expenses, increase sales, and create another stream of revenue for the insurers, allowing them to make good money. The insurers can launch partner programs, deduct a certain percentage of commission during policy purchase, enable in-app purchases, provide data analytics at some fees, and allow premium account creation with special privileges.

How does the Insurance App Work?

Having a mobile app for insurance agencies is a great user-friendly way to manage policies and claims. An insurance mobile application simplifies the entire process and conveniently provides standard solutions to policyholders and insurance providers.

Creating an account and filling up the basic details such as name, contact details, and address is the first step after opening an insurance mobile app. After the completion of the first step, customers can go through the application. Consumers can alter aspects of their insurance coverage, such as deductibles and coverage limitations, to meet their budgets and their unique needs.

After that, users can directly manage the policies through the insurance application. Also, they have the freedom to pay premiums, update personal information, and keep supervision upon submitted claims. Insurance policyholders are highly supported by this function when they need urgent medical attention. Inside the application, users can track application progress and ask queries/doubts of insurance providers.

Types of Insurance App

Exploring the world of insurance apps, insurance companies develop a variety of apps tailored to the services they offer, each designed to enhance workflow and improve user experience. Let’s take a closer look at these different types of insurance apps.

Life Insurance App

The life insurance application is built by the insurance company that offers insurance coverage to people in the event of death or disability. It helps users browse the policies provided by the insurers, calculate the insurance premium based on age and coverage needed, and apply for the policy. In fact, some apps allow users to access financial planning tools to make the right decisions about insurance coverage and send reminders for policy premiums. After getting the insurance policy, users can access and view the policy details and beneficiaries and manage other things.

Health Insurance App

Health insurance companies launch health insurance applications, allowing people to get health coverage based on age, health history, and lifestyle. The policyholders can access healthcare services, check the directory of a network of hospitals, and book medical appointments using digital insurance ID cards. Users can report claims, track claim status, and get reimbursement for the same. Health tracking tools provided by some health insurance apps encourage preventive care and promote a healthy lifestyle.

Vehicle Insurance Apps

Auto insurance companies build an insurance app, allowing vehicle owners to get coverage for the vehicles they own. The vehicle insurance apps provide insurance cards and policy documents that are accessible on mobile. Additionally, users will avail of emergency roadside assistance, timely reminders for policy premiums, and claim submission. Advanced vehicle insurance solutions track vehicles and monitor driver behavior and driving practices to provide personalized suggestions that improve savings and safety.

Travel Insurance App

Travel insurance applications are gaining traction with a growing number of people expedites worldwide. Travel insurance app helps travelers to cover unforeseen medical expenses, unfortunate luggage loss, unexpected trip cancellations, and other emergencies. Risk minimization during emergencies or medical expense reimbursement during accidents assures travelers of instant help and saves money.

Business Insurance App

Users investing money in diversified portfolios or businesses often feel the risk of getting huge losses. The business insurance app covers the need for insurance policy purchases that fit well with business size and risk capacity. The app ensures instant claim settlement for loss/fraud after document upload. Hence, users minimize the losses incurred during the business investment.

Property Insurance App

The property insurance app is a boon for homeowners or accommodation renters looking to insure their property by submitting the required documents and related photos/receipts. It helps users easily file a claim for damage/theft/loss and prevent potential risks with home security tips, weather alerts, and maintenance reminders. The timely assistance and apt resolution are the by-products that delight the customers.

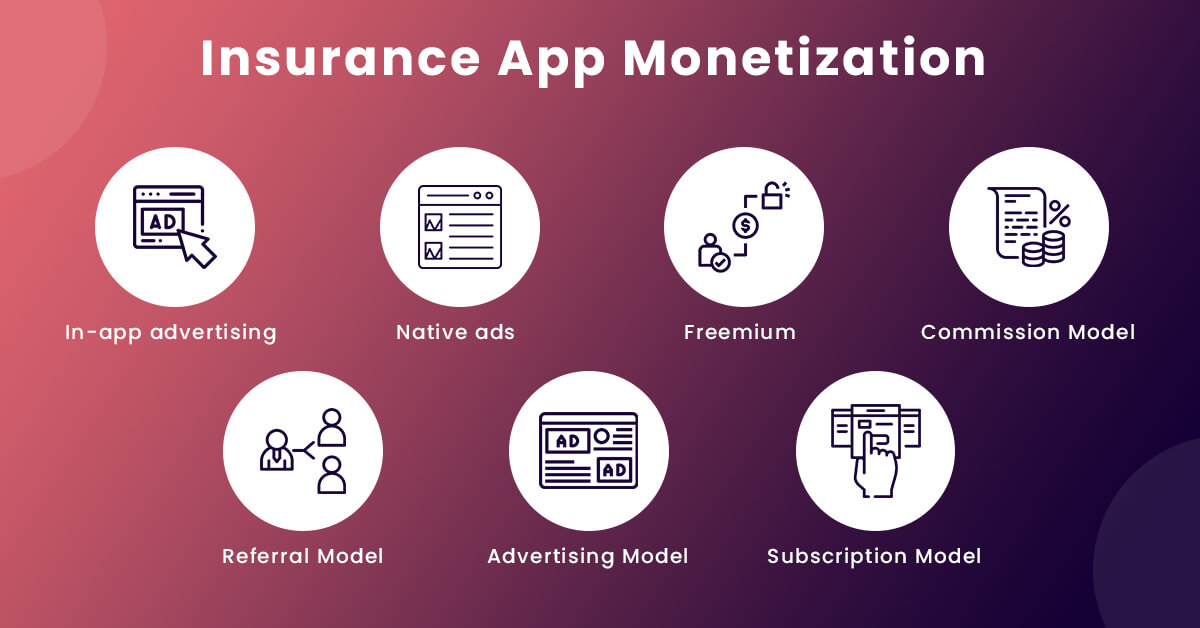

Insurance App Monetization

While the users continue to have hassle-free experiences, developers create several other ways to generate revenues from the application. For an insurance mobile application, here are a few ways to make money from the app. Let’s begin:

- In-app advertising: In-app advertising is a great way to drive better results and attract more target audiences.

- Native ads: These native ads feature ensures better overall ad performance which led to a higher rate of conversion and revenue. Also, it helps to build trust among your potential customers.

- Premium: It’s a trendy mobile app monetization model that has a wider user base. This model is highly scalable as it offers a “try first then buy” policy to the users.

- Commission: A commission model of an Insurance mobile application is a business model where a third party acts as a mediator between buyers and sellers, and charges fees for each transaction. The commission could be a fixed amount or a percentage of the sale price

- Referral: A referral model is a business model where an insurance company pays a reward to another party for bringing in new customers or leads. The reward can be cash, discounts, free products, or other incentives.

- Advertising Model: Advertising is a money-making model that refers to renting out a space to other companies to display their products and services on the insurance mobile application. The ads could be targeted based on the user’s profile, behavior, or preferences.

- Subscription Model: A subscription revenue model charges a recurring fee to provide access to a premium product or service of the Insurance app. The fees could be monthly, quarterly, yearly, or based on usage.

- Partnership: A partnership model involves more than one company coming together and earning from profits. Alternatively, a partnership can also occur with a finance-leading company offering funds and asking for some percent of the revenues generated by the Insurance company.

Best Features of the Insurance Mobile App

Features for insurance mobile app can be bifurcated according to the general as well as industry app development.

- Common Insurance App Features

- Customer Dashboard

- User Registration

- Manage Profile

- Document Repository

- Premium Payment

- Claim Management

- Policy Management

- Policy Quotes

- Premium Payment Options

- Notifications and Alerts

- Safety AspectsCustomer Support

- Payment Gateway Integration

- In-App Calculator

- Admin Panel

- Manage Users

- Document Repository

- Policy and Claim Management

- Manage Payment

- Reporting and Analytics

- Customer Dashboard

- Advanced niche-specific Features

- Life Insurance

- Real Estate and Property Insurance

- Vehicle Insurance

- Health Insurance

- Travel Insurance

- Business Insurance

Top 10 Insurance Apps

Technology advancements have given best option for insurance companies to transform processes, operations, and accessibility with insurance app development. Regardless of the type of insurance company, some companies partnered with insurance app development company and have successfully developed an insurance app, that’s working optimally.

- Lemonade – One of the best insurance apps which provide real estate insurance for policyholders. The app has been rated 4.9/5 and downloaded for more than 500K.

- Cuvva – It is one of the most progressive car insurance apps that deliver smart pricing, and quick and ultra-flexible coverage.

- Oscar – This is a sophisticated health insurance app that simplifies medical insurance. The app enables users to look up illness symptoms and medications, choose a doctor, schedule an appointment, and much more.

- Metromile – One of the customized car insurance applications that deliver personalized policies so that users can avail best options.

- HDFC life insurance app – It is one of the best and leading life insurance firms that covers insurance solutions like pensions, tax savings, investments, etc.

- myCigna – This is a global healthcare insurance company that covers effective insurance with quick on-the-go access and also allows users to personalize it.

- GEICO mobile app – One of the most effective auto insurance mobile apps that offer in-app parking locators, voice commanders, digital ID cards, and a lot more.

- PolicyBazaar – One of the best policy apps that let you compare policy quotes and plans from different insurance service providers.

- Esurance – Esurance company created an insurance app, which provides a variety of coverage for home, car, life, and pet insurance. It is recognized as the best Insurtech company globally for its intuitive interface, rich functionalities, and advanced integrations. It’s making the lives of the people in the USA easier.

- TravelSmart – The travel insurance app is a life savior for foreign travelers when they need instant help during medical emergencies or other situations. The translator functionality allows users to communicate with medical personnel in different countries and use geolocation functionality to reach out to the nearest hospital or pharmacy. The popular app featured in Forbes allows users to file a claim and track its status in real-time.

Tech Stack used for Insurance App Development

Mobile app development requires a specific tech stack to build customized products. For insurance, too, the major focus will be on the technology stack that can help to build a successful app that is fast, safe to use, scalable, and have minimum turnaround time. In addition to enhanced technologies, these are also utilized in developing a mobile insurance application.

Here, is the most precise list of the mobile app technology stack that can be used to make a leading Insurance app.

- Native mobile app

- Android: Java, Kotlin, Android Studio, Android UI

- iOS: Objective C & Swift, Xcode, UIKit

- Cross-Platform App: React Native, Flutter (Dart), JavaScript, Xamarin

- Payment Gateway: Stripe, PayPal, Braintree

- Server: Apache, Nginx, Microsoft IIS.

- Hosting: Microsoft Azure, Google cloud service, AWS (Amazon Web Services)

- Database: MySQL, MongoDB, Cassandra

- Storage: Google cloud storage, Amazon S3, Microsoft azure storage

Using these aforementioned tools, insurance app developers make sure that the app is equipped with top-notch tools for scalability, safety, and optimum performance.

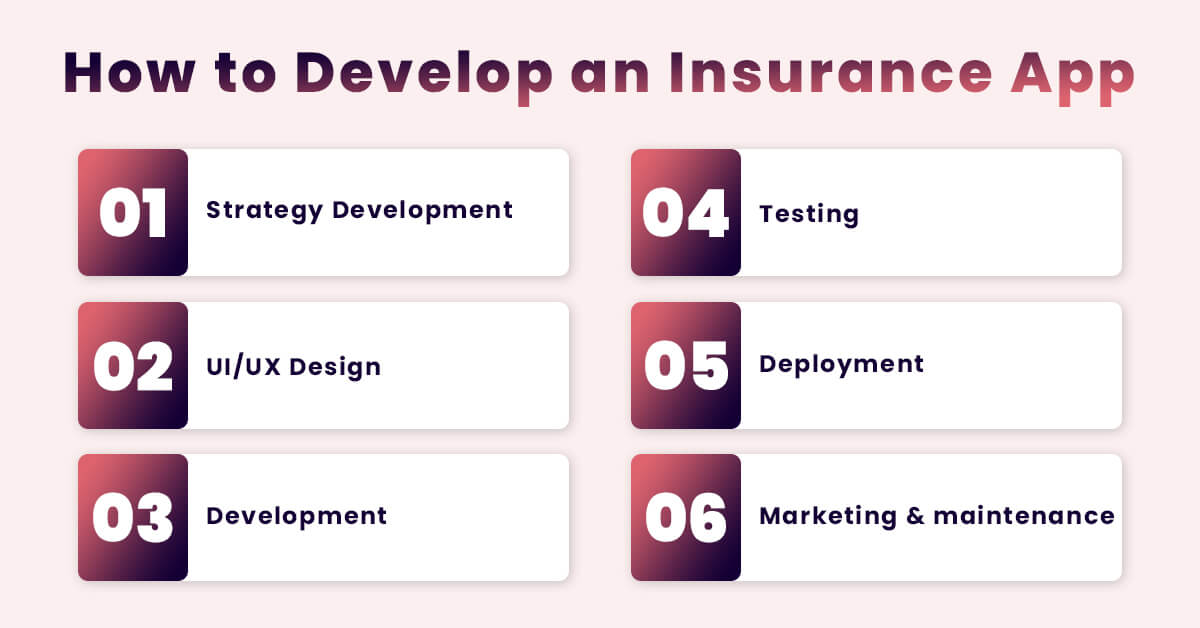

Steps to Develop an Insurance App

The steps to build an insurance mobile app aren’t different from the steps to develop an app. By creating and launching an insurance app, an insurance company will be able to meet digitized needs, fulfill consumer requests, and a lot more.

There are mobile app development companies that can develop an entire insurance application if they have verified the hypothesis, processed customer input, and assessed key performance metrics.

Here are the steps to follow:

Strategy for App development

First of all, a strategy that is created based upon the overall aspects of an insurance company and insurer needs is a must-have. Apart from these, recent trends and additional opportunities are needed to be kept in mind to include all the latest modifications in the app.

Mobile App UI/UX design (wireframes)

After having a strategy, in the next step a creative design is a crucial task to complete. One of the most important tasks is to perform prototyping to ensure the correctness of all the implied factors.

Insurance Mobile App Development

What tools, features, and capabilities will be significant for an insurance app, should be decided upon before developing an MVP. As policyholders begin making use of the application and based on the user’s feedback, the remaining functionality can be implemented.

Testing of Insurance mobile app

Whenever an insurance mobile application is created, it goes through a process of testing before it is made available to the users. QA guarantees stability and dependability which are the two vital factors that an insurer requires in the mobile application.

Insurance App Deployment

Once all the processes are completed, the insurance application is released on app stores like Google Play, Apple Store, and other app-downloading platforms. This ensures easy and safe access to the insurance app for its target audience.

Maintenance of the Insurance App

As per the insurance market trends and the latest technology updates, mobile apps must be updated regularly to ensure hassle-free work on all the latest platforms.

Want to delve deeper into mobile app development? Read this guide.

Advanced Technology in the Insurance App

Well, cutting-edge technology is already making its way into the insurance companies, and several other advanced technologies are helping it make better. Jotting down a few enhanced technologies that can be used to develop a mobile app for insurance agencies.

Predictive analysis

It helps improve accuracy for insurers, especially for property and casualty coverage. It also streamlines claim processes by policyholders and mitigates risks that traditional claiming methods have.

Telematics

Mainly benefitting auto insurers and policyholders, telematics is offered widely through wearable tech for car insurance policies. Based on mileage and driving behavior, the insurance policy operates.

Drones

Since Hurricane Harvey hit in 2017, insurers have been using drones to expedite all their claim processes. High-quality video and images shall be embraced by insurance companies as state-of-the-art technology for their business.

Chatbot

Offering assistance 24/7, the insurance chatbot shall help all clients in selling insurance products plus assist them in facilitating claim processes earliest. Customers opine that such a feature is quite helpful, especially in health insurance applications.

Cost to Develop an Insurance App

There is no such hard and fast cost fixed in building an insurance app. The distinct parameters are considered while creating an estimated budget for building an insurance application.

The cost of an insurance app development sums depending upon:

- The complexity and size of the project

- Business objectives

- Functionality and interactions

- Development platform (iOS, Android, Hybrid, Cross-platform, etc.)

- Technology stack

- App developer’s charge

- Invested time and so on.

Rates to develop an Insurance application may vary depending upon MVP for a single platform which is around $30,000 while for both platforms (iOS and Android) it costs start from $10,000 to 500,000. It can go higher if you want to add more advanced functionality to your insurance app.

It’s all about playing safe!

Looking at the current scenario, insurance mobile apps are a necessity rather than an option. Insurance companies should have a customized mobile app, as it has numerous privileges like meeting the market trends, improving the number of users, generating revenues, and outperforming competitors.

While most Gen Z prefers to use a mobile application, it is very essential to shift insurance providers toward the digital world. Also, an insurance mobile app streamlined the entire process of policies, claims, retention rates, and much more. Thus, you may outsource mobile app development to build a customized tool for your insurance company.

FAQs About Insurance App Development

How much time is consumed in developing an insurance mobile app?

Within 2-3* months an MVP for Insurance app is created but developing an entire mobile application takes around 5-6* months depending upon the requirements.

By using cross-platform app development tools, can an insurance agency app be developed?

Yes, an insurance app can be created using cross-platform frameworks such as Flutter and React Native to build a single app that works on both iOS and Android at less cost and time.

What other safety features are available in the insurance application to protect customers’ personal information?

Apart from data encryption used in the Insurance app development process, there are other safety measures that can be taken to secure the app at the users’ end such as Biometric authentication, and two-factor authentication.

Avantika Shergil

| Sep 2, 2024

Avantika Shergil

| Sep 2, 2024

Avantika Shergil is a technology enthusiast and thought leader with deep expertise in software development and web technologies. With over 8 years of experience analyzing and evaluating cutting-edge digital solutions, Avantika has a knack for demystifying complex tech trends. Her insights into modern programming frameworks, system architecture, and web innovation have empowered businesses to make informed decisions in the ever-evolving tech landscape. Avantika is passionate about bridging the gap between technology and business strategy, helping businesses build customized software and website, and understand about different tools to leverage effectively for their ventures. Explore her work for a unique perspective on the future of digital innovation.