If we go by books, the word fintech includes finance and technology; in other words, fintech is a portmanteau of those terms. The term refers to any finance business that uses technology to provide flawless financial services, including online transactions, coupons and deals, banking, loans, and even investments and recovery.

The global fintech market size is projected to grow at a CAGR of 16.8% between 2024 and 2032, reaching a value of around $917.17 billion by 2032. The technology progress, government initiatives, and others are making fintech organizations embark on the fintech app development bandwagon and earn a share of revenue expected to reach 188 billion Euros in 2024.

It indicates a great scope and big bucks in the field, which is why Fintech app development of Fintech application has embraced newer technologies and solutions. Finance companies and their clients have adapted to the new wave of financial services through digital modes. As a result, even small and medium-sized fintech businesses have started to outsource fintech app development to offshore companies.

Table of Contents

- Fintech entrepreneur – a businessperson with a different eye

- Market overview of Fintech application development

- Top Reasons to Invest in Fintech App Development

- Types of Fintech Applications

- What are The Business Benefits of Fintech App Development?

- Fintech Software Solutions – From Thought to a Customized Product

- How to Build a Fintech App in 6 Steps?

- Key Features to Consider When Developing Finance Management Apps

- What You Need to Know Before Developing a Fintech App?

- Best Monetization Strategies for Fintech App

- Top 5 Fintech Apps used worldwide

- How much does it Cost to Develop a Financial App?

Fintech entrepreneur – a businessperson with a different eye

While the rest of the entrepreneurs think in a general direction, fintech entrepreneurs have a different angle to quench their business thirst. With advanced thinking, these think-tanks reinvest customer services through outstanding fintech mobile apps while sticking to the rudiments of the basic finance business model. If you are among those special ones, this guide will take you through the fintech app development lifecycle so that you get the final product that functions flawlessly and is aligned with your business objectives.

Market overview of Fintech application development

Digital innovation with AI, ML, and IoT technology allows financial organizations to break new ground along with evolving customer behaviors. Enabling mobile payment, real-time payment, high security, and best customer experience allow businesses to thrive in the new fintech era. Robo-advisory-like services help democratize investment opportunities, enhancing the organizations’ financial well-being.

The results viewed from the growth of the fintech industry at an extraordinary pace. A significant increase in fintech users, around 0.36 billion, was found between 2018 and 2027. The positive trend is accompanied by the growth of digital fintech transaction value, which is forecasted to reach $14.78 trillion by 2028.

Additionally, if we go by market capitalization, fintech businesses in the USA and China lead the ranking. As of January 2024, the two largest fintech businesses were the payment companies Visa and Mastercard, with a market capitalization of roughly $520 billion and $396 billion, respectively. Intuit, a company that develops financial, accounting, and tax preparation software, ranked third, and Chinese Tencent ranked fourth with a market capitalization of $146 billion.

A deep dive into fintech figures shows that it’s the right time for banks and financial start-ups to build an app that drives new earning opportunities and meets evolving customers’ needs.

Top Reasons to Invest in Fintech App Development

Digital finance companies have gotten terrific funds and investments in the past few years. With growing figure of start-ups all across the world, more and more entrepreneurs are now seeking to venture into businesses with secure financial transactions. On the other hand, mobile literacy has increased among people and so have shopping habits, which as turned from a shop to online. Overall, mobile application penetration into almost every sector has given a markable boost in online services that include financial transactions in one or other ways.

The fintech applications have got a further boost from the unprecedented pandemic that hit the world and made it stand still for a considerable time. The habit of dealing with personal and professional tasks online was forced upon users once has now become a stubborn habit and hobby for almost everyone.

Even further, stringent frameworks and stricter finance transaction norms have made fintech mobile apps to be more secure, trustworthy, and a time-saving alternative. It is worth mentioning that the advent of cryptocurrencies and many countries legalizing them has pushed fintech applications development to unrivaled competition; thus, it is not exaggerated to say that this is the right time to develop fintech mobile apps.

Types of Fintech Applications

Finance technology includes several fields and sectors. That said, there are many types of fintech mobile app development possible. Depending on what your business is up to, you can hire fintech mobile app developers to build quality solutions. On that note, if you are looking at a larger scale catering to multiple types of users across various devices then you can opt to build a fintech software.

Generally, the types of financial software solutions can be bifurcated as

- Banking

- Payment apps

- Insurtech

- Investment apps

- RegTech

- Digital cards

- Micro-investment

- Stock and commodity trading

- Cashback and reward

- Insurance Apps

- Loan & Money lending

- Saving management

- Portfolio management

- Transfer and forex

- Currency exchange and transfer

- Billing and accounts

- Personal Finance Apps

- Cryptocurrency Apps

- NeoBanks

While each of the above-mentioned types could have its own mobile application, a large fintech app development solution can include one or more of the above. You need to discuss this with companies that offer fintech app development services. But, largely, all fintech mobile applications could do excellent business.

What are The Business Benefits of Fintech App Development?

Finance services are expected to be quick, accurate, secure, and seamless. Increasing mobile literacy, secure transaction assurance, and the advent of cryptocurrency are pushing the development of fintech apps. Choosing the best mobile app developers with expertise in providing digital services for the fintech industry assures that businesses get a final product that is up to the mark and the following top business benefits –

Streamline payment method

Nowadays, people are accustomed to making payments using various payment gateways, including Stripe, Braintree, PayPal, mobile wallets, credit/debit cards, and others. Fintech growth allows fintech organizations to offer many payment options so customers can pay however they want. SMBs prefer using online banking that integrates with mobile apps, which helps make cash flow management more effortless.

Improved access to financing options

Getting a loan from the bank involves several visits to the financial organization, which is tedious and time-consuming. That’s where fintech app development allows customers to apply for a loan and get it approved in a few taps. Disrupting the credit market, the fintech app enables customers to extend their credit history and learn alternative ways to get required funds.

Client-friendly features

Your clients drive your fintech business. A customized fintech app solution can make things easier for your esteemed clients. They can quickly manage their finances through the mobile software; the user interface and client-centric features make tracking their spending and achieving their budget goals easy. With a personal finance management app, they would stick to your financial services.

Significant savings, a wise investment

A fintech application customized to the services and features you offer to your clients can bring down banking and investment fees. The transfers between accounts and depositing funds could be accessible according to various finance business models. You can integrate several APIs into your custom fintech app development.

Gain new customers while retaining the old ones

Trending fintech apps help businesses tap new customers through their mesmerizing user interface and easy navigation. On the other hand, the old clients stick to it because the Fintech mobile apps offer hassle-free banking, finance, trading, and even stock services. Even further, customized finance mobile app development can include several other features. Consumers demand eWallet and other features such as debit/credit card management, online digital payment, fund transactions, and even comparison of investment plans.

Offer robust security measures

Clients of any finance company are chiefly concerned about the security of their accounts. With customized development of the fintech mobile app, you can add multi-layered/tier securities to your software tool, using which your clients feel secure and in safe hands. Many options are available to secure payment gateways, digital fund transfers, and account management (profile and crucial information).

Fintech Software Solutions – From Thought to a Customized Product

With a recent report by the world’s largest market research store Research and Markets, it is forecasted that the total value of digital wallet transactions will grow 77 percent by 2028 to $16 trillion worldwide.

Though it is a lucrative business, you should consider the app development process step by step. There are seven factors you need to go through before you ask your tech partner to develop your fintech app solutions. Here are they –

- Identify the startup niche, which finances services in specific

- Analyze competitors – their strengths and weaknesses

- Identify your strengths and weaknesses

- Plan priorities – what do you want first and what can be achieved later

- Find a company for a custom fintech app development

- Build an efficient team of dedicated fintech app developers

- Discuss your project, its feasibility, and Fintech app development cost

How to Build a Fintech App in 6 Steps?

Building a fintech mobile app is not a straightforward process. It includes many development stages -from merely a thought to a full-fledged finance app. While the general steps have been already mentioned previously, here we shall also focus on the technical aspect of the fintech app development stages.

In all the procedures, it is highly recommended that you hire or consult a fintech expert to assist you in carrying out a foolproof plan. Alternatively, you can also ask top fintech app development companies to provide you with business and technology consultants from the finance sector.

Here are some steps for developing fintech software:

Set the goal for your Fintech app

The very first step toward offering the best user experience to your clients is to set the goal for your Fintech app. You should figure out what your mobile app shall do to offer a memorable experience to users. What kind of problems a Fintech app user faces that you can solve by your Fintech mobile app. Ask yourself what your clients expect from the automation of your services. You may retrospect and learn from your experience in the finance business.

Right platform for customized Fintech app development solution

There are many technologies available for creating a Fintech app, and choosing the right one is important to avoid hassles later. While most finance app development services are available for both the platforms Android and iOS, you should choose the platform wisely depending on your customer base. Nevertheless, some Fintech service companies opt for cross-platform app development or hybrid Fintech app development solutions to cater to the widest range of targeted consumers.

UI/UX and engagement

Fintech app solutions should have a highly engaging yet simple user interface to render the best user experience. Sketching your user interface will help you decide the overall look and feel of the programming tool and a lot will depend on it. Creating various wireframes by keeping fintech experts by side helps you define your finance software features. For an intelligent fintech entrepreneur, MVP (Minimum Viable Product) is carried out to save budget and still get your product on board.

Fintech compliances

The finance sector is one of those few fields where security and privacy are taken very seriously. Even further, the complexity of rules, regulations, and compliances varies from country to country. Therefore, these factors are kept in mind when you think about contacting a leading mobile app development company from the best ones to develop a customized Fintech app. Data encryption and PIC DSS for storage, and other local/regional compliances must be kept in mind. Alternatively, you can ask your tech partner to talk to your finance experts who are experienced in compliance. While you focus on implementing and assuring finance compliance, other stringent standards should be followed for Fintech mobile applications adhering to laws.

Create mockups and ensure flawless backend

Creating mockups helps to get updated with every phase of progress and milestone. You can ask your technology partner to create mockups frequently to ensure that app development process is on the right track. Any escalation should be addressed as early as possible before it gets into complexity. A streamlined Fintech app development life cycle makes the product align with the organization’s goal and business objectives.

Build a prototype and throw the ball to users

The ultimate way to test the product is to create its prototype and test it with the actual users, and the Fintech mobile app is no exception. The real feedback comes from the users and stakeholders of the product as they would give you honest opinions. You need to pay heed to their feedback and work on it with the help of fintech app developers.

For an intelligent fintech entrepreneur, the best way to gauge the fintech market is to develop an MVP (Minimum Viable Product), which is carried out to save time & budget and still get your product online for your consumers. This can be a masterstroke for your fintech business that will help to gauge various features and address the major pain points of your target consumers.

It has been found that most of the top performing apps on the app stores today, have had a history that the required changes were made in those applications to address their customers’ pain points. Such upgradation can result in supercharged engagement from the consumers even in the fintech industry.

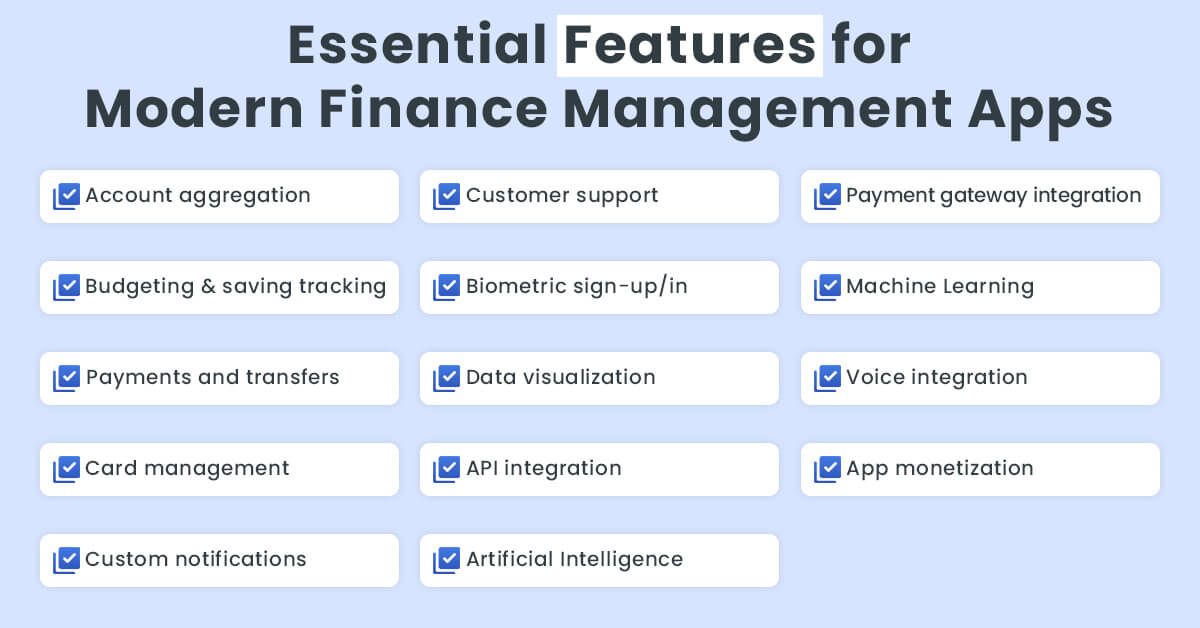

Key Features to Consider When Developing Finance Management Apps

Apart from the general user-friendly mobile app features, a company that offers you fintech mobile app development services can get you additional relevant features upon your request. Nevertheless, they all come with extra costs and that is why it is important to clarify them beforehand only.

Account aggregation

The centralized access to finances allows users to control them better. With account aggregation, users can view detailed information on different bank accounts, investments, loans, etc. A single view makes things convenient.

Budgeting and saving tracking

Finance management is an arduous task that requires setting a budget, expense analysis, and tracking savings. Fintech app allow users to do it effectively on a single screen.

Payments and transfers

Money transfer has become a common phenomenon that users expect at the least. So, ensure the Fintech app facilitates hassle-free instant money transfers or payments for bills such as utility, credit card, rent, and more.

Card management

Nowadays, people have so many cards that it takes time to manage them. Frequent switching to different apps is an inefficient process. Fintech apps fix these problems by allowing users to view transactions, lock or unlock cards, change limits, etc.

Custom notifications

Users are less likely to prefer to receive all types of notifications. The app should allow users to customize notification categories such as account transactions, investment statuses, and others so that relevant notifications are delivered to the users.

Customer support

Customer support is an inevitable part of every application. The Fintech app should enable a customer support feature so that users can get their queries resolved 24/7. The AI integration makes customer support robust.

Biometric sign-up/in

Biometric sign-in is a new way to get to the personal dashboard. Clients don’t want any hassle in accessing their finance account on Fintech mobile app solution and that is why most users expect biometric signup and login.

Data visualization

Though you include analytics in your application. Skilled fintech software developers can get you special and advanced data visualization options wherein clients can have accurate information on their spending, insurance, and other data visualization to carry out a foolproof strategy for their fiscal trades.

API integration

Today, mobile applications can be enhanced for their functionalities and ease through easy API integration. Finance web application development can have API integrations while the process is going on. You need to study and research the features and facilities your clients need. Checking on whether such APIs are readily available will help your finance application software become successful.

Artificial Intelligence

Contemporary digital advances include the use of AI (Artificial Intelligence) in almost every mobile application for all fields and sectors. More than 80% of Fintech companies use AI to secure their Fincance apps and automate redundant tasks. Powering up your fintech app development with AI will help boost the security of your fintech mobile app. It can also help to incorporate different features such as biometrics, voice detection, and facial recognition that can help with digital identity verification in real-time.

Payment gateway integration

A fintech application without an integrating secure payment gateway is like a sword without a sharp edge. You can ask your remote fintech app developers working dedicatedly to integrate third-party APIs and other ways for secure digital transfer or exchange of funds.

Machine Learning

With AI generally comes ML because the application shall learn from the inputs it gets from the users. The combination of AI and ML can make your fintech app development solutions powerful and understanding. As a result, the application shall produce better data and help users make strategic decisions that are foolproof.

Voice integration

One of the fastest-rising trends in almost all sectors is voice search or command. According to eMarketer, more than 40% of the US population uses voice search features. Integrating voice search shall enhance your fintech app toward a roaring success.

App monetization

Some entrepreneurs solely develop finance apps as they see it as a lucrative business. Fintech mobile apps can have certain special features that help you monetize your application through various ways and business models. However, such an addition would come at an extra development cost if not discussed beforehand.

What You Need to Know Before Developing a Fintech App?

The success of a mobile application is its features and facilities to users, and the solution that it provides to users’ pain points. Even a renowned company’s app may fail if it does not stand up to users’ expectations. Hence, before you ask a custom fintech app development company for a personalized product, mind these factors to have in your product as they assure you fairly increased chances of success.

Authenticate and manage users

Fraudulent transactions and dummy accounts have been a big nuisance to fintech applications. Ask for a robust system to authenticate and manage Fintech app users.

Get secure hosting

Safety and security are the two pillars on which any fintech app grows. Secure hosting assures you that your Fintech mobile app is in the safe hands and any breach is less likely to occur.

Credit score checking

Along with general features, credit score checking is one of the most important facilities a fintech app should have. Most banks and Finance companies rely on credit score to lend money or raise any company sufficient funds.

Access bank account

A holistic approach to a finance service mobile application would be having secure access to the Bank account. Almost all banks have APIs that you can ask an expert fintech app development company to integrate into your fintech software.

Chat or chatbot

The latest trend that has captured the mobile app development market is the chat feature or a chatbot. Addressing clients’ or customers’ concerns as early as possible is a key to any business success, and the Fintech industry is no exception.

Bonus plugins

Fintech applications could have plugins according to the business requirements or objectives. Adding several plugins or at least keeping an option of having plugins shall help you better your Fintech software application.

Legal obligation

Finance is one of the riskiest businesses as it involves the transaction of money and there are fair chances to fall in legal consequences. Having a legal obligation for your fintech mobile app shall be the safest way to venture into automatizing your finance business.

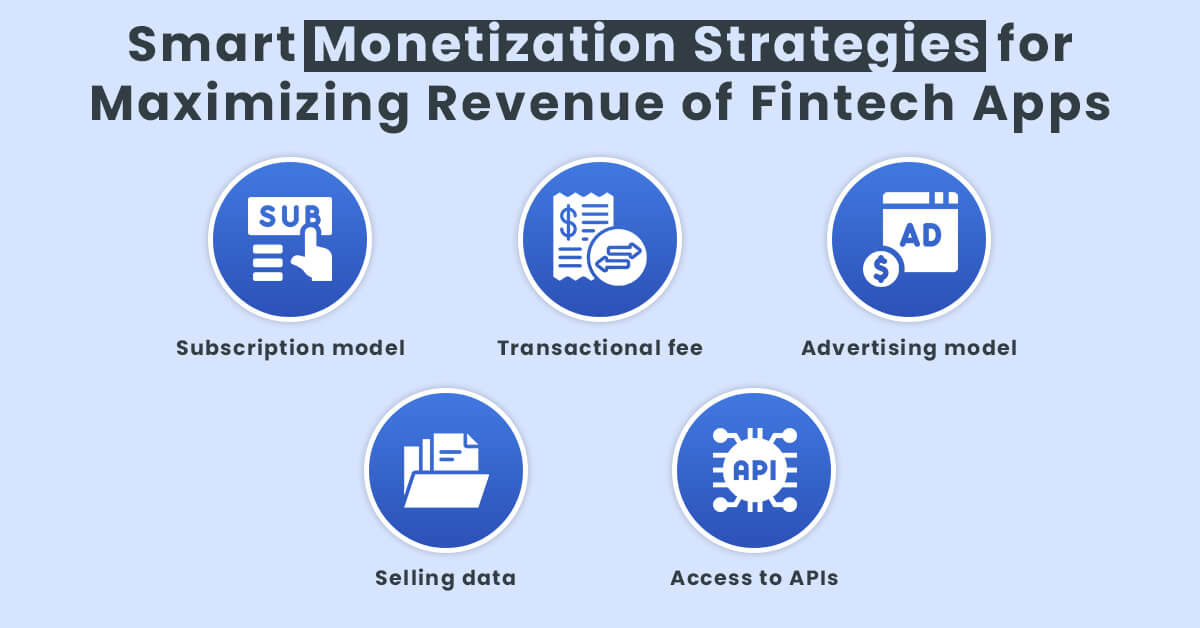

Best Monetization Strategies for Fintech App

Before building a Fintech app, entrepreneurs always expect to get something in return that requires thinking about monetization models and integrating them into the app. There are different monetization models that fintech businesses can incorporate based on the type of their application.

Subscription model

The popular revenue model allows users to subscribe to fintech services by selecting one of the packages created based on the number of features. A trial period is facilitated that enables users to get around the app for a week or two. As the trial period ends, users must subscribe to continue using the app’s services.

Transactional fee

The primary monetization model involves applying fees on all transactions or specific transactions such as global transfers, funds remittances, and others via Fintech mobile app.

Advertising model

The Fintech app with a large enough user base can use the advertising model for revenue generation. Users can access the app’s services for free, but relevant ads appear at different places. The app owner gets paid when users view or click on an advertisement.

Selling data

Fintech apps hold massive user data that are highly valuable when organized, analyzed, and used strategically. The Fintech app owner can sell this valid financial data or enable paid access to third parties to optimize sales and marketing strategy using quality data.

Access to APIs

Fintech organizations with payment gateways and other services can offer APIs that businesses can use in their software projects. Say PayPal offers PayPal API that businesses can integrate to mobilize payment options. Access to APIs requires businesses to pay monthly for API resource consumption.

Top 5 Fintech Apps used worldwide

Before embarking on the fintech app development journey, you should know the best apps offering diverse financial services. Look at the top 5 fintech apps offering convenience, enabling secured transactions, providing real-time insights, helping users, and making financial management more effortless.

- Moneylion

- Robinhood

- Chime

- Nubank

- Revoult

How much does it Cost to Develop a Financial App?

You, as an entrepreneur, might have heard a lot of suggestions from your friends and peers from the finance industry about the budget required to build a Fintech app. But still if you are clueless about the pricing and the aspects based on which you are given the ballpark amount, we can help you understand the budget or funding required to develop a fintech app and the various associated factors.

Nevertheless, the actual figure is best quoted only by a company experienced in fintech app development. Generally, the companies do undertake the following factors before quoting you the price of developing a finance mobile app –

- Business and competitors analysis

- MVP and prototypes

- User interface design (research and development)

- Backend programming

- Frontend platforms and frameworks

- Quality assurance and testing

- Content and more (such as marketing, maintenance and support, and so on)

Other than these factors, which licensed tool your app will require, plus the number of dedicated fintech app development team members, the total time required to create the app, and the complexity of Finance app affect the total cost calculation.

If you still want a rough figure on the fintech app development cost, here it is.

- Development of Banking application costs around $40,000-$70,000

- The cost to develop a Lending app may range between $30,000-$50,000

- Insurance app development requires you the budget of around $45,000-$70,000

- For an Investment fintech app you should have a budget of nearly $60,000-$120,000

- The price to build a Consumer finance app shall fall between $50,000-$300,000

The location of the fintech app development company also affects the overall price of the fintech software application. While a European fintech app development firm will quote you between $200,000 to $600,000, a North American fintech mobile app development agency can go up to $600,000 to $800,000. Remarkably, a renowned Indian fintech app development company shall do the task at almost half of the prices quoted above.

Ultimately, after going through the fintech app development guide thoroughly, you should be able to understand the nuance of finance technology. It is high time that you upgrade your obsolete system and provide your clients with a cutting-edge finance solution to stay ahead of your competitors to lead the fintech market.

Frequently Asked Questions About Fintech App Development

What is a FinTech mobile app?

A fintech mobile app is a solution that enables individuals and businesses to mobilize financial operations using the right mix of technologies and tools.

How do Fintech apps make money?

Fintech apps make money using different monetization models, including subscription, advertising, transaction-based, significant data selling, and paid access to APIs.

How long does it take to build a financial app?

Financial app development usually takes three months to a year, depending on project size, team composition, and more.

How do you select the best fintech app development company to hire?

You can choose and select the best fintech app development company to hire by browsing their portfolio, checking client testimonials, communicating with their existing clients, and interviewing the developers.

Avantika Shergil

| Feb 22, 2024

Avantika Shergil

| Feb 22, 2024

Avantika Shergil is a technology enthusiast and thought leader with deep expertise in software development and web technologies. With over 8 years of experience analyzing and evaluating cutting-edge digital solutions, Avantika has a knack for demystifying complex tech trends. Her insights into modern programming frameworks, system architecture, and web innovation have empowered businesses to make informed decisions in the ever-evolving tech landscape. Avantika is passionate about bridging the gap between technology and business strategy, helping businesses build customized software and website, and understand about different tools to leverage effectively for their ventures. Explore her work for a unique perspective on the future of digital innovation.