Modern customers are empowered by sophisticated technologies and seek bespoke solutions to simplify their financial management. This shift has propelled e-wallet apps to the forefront of mobile payment trends. Platforms like PayPal, PayTM, and others are experiencing rapid growth and are poised for further evolution.

The adoption of digital wallets is accelerating globally. In 2023, digital wallets accounted for 50% of global e-commerce payment transactions, a figure projected to rise to 61% by 2027 as per Finder. As per Statista, This trend is particularly pronounced in the Asia-Pacific region, where mobile wallet penetration is significantly higher than in Europe.

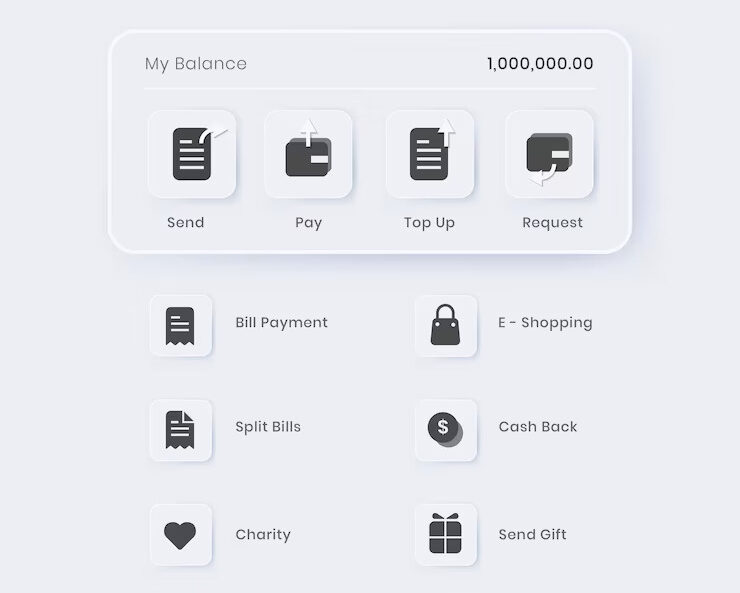

When the pulse of e-wallet trends is checked, it’s found that modern e-wallets need to facilitate several financial tasks other than basic features of mobile eWallet app to maximize ROI. To remain competitive and relevant, integrating advanced features is crucial for the success of e-wallet apps. Take a deep dive into the list of features that e-wallet apps need to incorporate to obtain loyal customers.

Table of Contents

- Best Key Features That Make Your E-wallet Application Stand Out

- Seamless Customer Onboarding

- Instant Payments

- Contactless Merchant Payments

- QR-enabled Technology

- Payment Process is Simplified

- User-friendly

- AI-Powered Personalization

- Integration with IoT (Internet of Things)

- Cross-Border Payment Capabilities

- Biometric Authentication

- Support for Cryptocurrencies

- Support for Multiple Currencies

- Decentralized ID (DID) Integration

- Seamless Transactions

- DeFi Integration

- Easy Navigation

- Integration with Multiple Payment Gateways

- Integration with Partner Brands and Businesses

- Option to Add Multiple Payment Methods

- Integration with Other Apps and Services

- 24/7 Support through Live Chat or Call

- Automated Verification

- Management of Physical and Virtual Card Operations

- Split Bill

- Loan Origination

- Chatbots for real-time assistance

- Transaction History and eWallet Passbook

- Wallet-to-Bank and Bank-to-Bank Money Transfers

- Peer-to-Peer (P2P) Payments

- Bill Payments

- Security and Data Integrity

- Self-Registration

- Personalized Loyalty Rewards and Discounts

- Expense Tracking and Budgeting

- Ready to include top features in your E-wallet app?

Best Key Features That Make Your E-wallet Application Stand Out

Seamless Customer Onboarding

The regulatory requirements in the FinTech industry make it necessary for e-wallet service providers to ask for customers’ identity and financial information. This makes the onboarding process troublesome for new users and encourages app abandonment. One study revealed that almost 40% of customers abandon a mobile app during the onboarding process.

Hence, e-wallet service providers must provide their users with a seamless customer onboarding experience while keeping regulatory compliance intact. One way of doing it is to allow your customers to verify their identity online by taking a picture of their documents via your mobile e-wallet app. Moreover, the user interface and user experience are also vital to keep the onboarding process interesting.

Instant Payments

It will not make sense to call your mobile payment app a “wallet” if the users cannot make payments instantly due to technical issues such as server errors. Hence, your e-wallet app’s availability is essential to give users a sense of immediate access to their money. An instant payment feature is the one that will realize a cashless society. Furthermore, another vital aspect to consider for ensuring seamless and secure transactions is payment gateway integration. It enables a smooth and hassle-free transfer of funds from the user’s e-wallet to the merchant’s account.

Contactless Merchant Payments

“Effortless” is the word you should focus on while developing payment options for your mobile e-wallet app. Needless to mention that more and more merchants are adopting emerging financial technologies to facilitate cashless payments. Contactless payment methods such as NFC (Near Field Communication) make the customer checkout experience effortless.

Did you know Coca-Cola was among the first companies to implement mobile payment technology?

QR-enabled Technology

E-wallets are increasingly using QR technology to enable hassle-free transactions at speed. It involves QR code scanning by the users through their e-wallet app, which is shown at the merchant’s checkout counter. Digital wallets remove the need for providing payment information or card details. The QR-enabled transactions are safe, reliable, and efficient. Hence, including such a feature would be beneficial to your e-wallet app.

Payment Process is Simplified

A feature that helps make payments for different purposes, say gas, electricity, mobile recharges, bills, and other bookings like train, flight, bus, hotel, and more. The e-wallets should also facilitate an auto-payment option along with reminders so that payments are never missed. This way users can seamlessly manage and pay for the routine or monthly expenses conveniently.

User-friendly

Mobile wallets are meant for convenience and reliability. Therefore, it requires the E-wallet app UI to be intuitive and user-friendly for keeping tabs on transactions. Also, having a user-friendly e-wallet app enables users to carry out various actions such as adding money to the wallet, fund transfers, and balance checking with ease. This will encourage users to use your e-wallet app repeatedly for any transaction and make them your regulars.

AI-Powered Personalization

Artificial Intelligence (AI) has revolutionized the way users interact with digital solutions, and mobile wallet apps are no exception. By integrating AI, your e-wallet app can analyze user behavior, spending patterns, and preferences to deliver a personalized experience. AI and Personalization go hand in hand, enabling features such as tailored spending insights, predictive financial suggestions, and dynamic notifications that ensure users feel valued and engaged.

For instance, the app can notify users of their recurring payments, suggest cost-saving opportunities, or offer exclusive discounts based on their activity. This not only enhances user satisfaction but also fosters long-term loyalty, positioning your app as a smart financial companion.

Integration with IoT (Internet of Things)

The Internet of Things (IoT) is shaping the future of connectivity, and incorporating IoT into your digital wallet enhances convenience and accessibility. Imagine a scenario where users can make payments through their smartwatch, voice assistants, or even their connected vehicles. By enabling seamless transactions across IoT-enabled devices, your mobile wallet app becomes an integral part of the user’s connected ecosystem.

This mobile eWallet app feature caters to tech-savvy customers who value innovative solutions, ensuring your app stays competitive in a rapidly evolving market. Additionally, IoT integration can open opportunities for partnerships with device manufacturers, expanding your app’s reach.

Cross-Border Payment Capabilities

In a globalized world, cross-border payments are becoming increasingly relevant. Empower your e-wallet app users with the ability to make international transactions effortlessly. This feature can include real-time currency conversion, minimal transaction fees, and multi-currency wallet support, making it ideal for frequent travelers, freelancers, and global businesses.

By simplifying international payments, your digital wallet can attract a broader audience and become a preferred choice for users seeking versatile financial solutions. This capability is particularly crucial in regions with significant remittance flows or cross-border trade.

Biometric Authentication

Security is paramount in the world of digital payments. Biometric authentication, such as fingerprint scanning, facial recognition, or voice verification, ensures that only authorized users can access their accounts. This advanced security feature of the eWallet application not only protects user data but also enhances the convenience of accessing the mobile wallet app without remembering complex passwords.

Incorporating biometric authentication into your app builds trust among users, addressing their concerns about safety and making your e-wallet app a preferred choice for secure transactions.

Support for Cryptocurrencies

As cryptocurrencies gain traction worldwide, integrating crypto support into your digital wallet adds significant value. Allow users to store, manage, and trade popular cryptocurrencies like Bitcoin, Ethereum, or stablecoins within your app.

This feature broadens the app’s appeal to crypto enthusiasts while positioning it as a forward-thinking solution. Features like real-time price tracking, secure crypto wallets, and seamless exchange options enhance user satisfaction and make your e-wallet mobile app a comprehensive financial tool.

Support for Multiple Currencies

Catering to a global audience requires flexibility in handling various currencies. By offering multi-currency support, your mobile ewallet app enables users to transact seamlessly across borders without needing additional tools for currency conversion. Features like real-time exchange rates, transparent fee structures, and automatic currency detection simplify international transactions.

This feature is especially beneficial for frequent travelers, expats, and businesses dealing with cross-border transactions, positioning your mobile wallet app as a versatile solution for global users.

Decentralized ID (DID) Integration

In an era of increasing data privacy concerns, integrating Decentralized Identity (DID) into your digital app wallet provides users with control over their personal information. DID eliminates the need for centralized data storage, reducing vulnerabilities to breaches and enhancing user trust.

With DID, users can authenticate themselves securely without exposing sensitive information, making your e-wallet app an industry leader in privacy and compliance. This feature is particularly valuable for users in regions with stringent data protection regulations.

Seamless Transactions

The hallmark of a successful mobile wallet app is its ability to provide frictionless transactions. Whether it’s peer-to-peer payments, bill payments, or merchant transactions, ensuring smooth payment flows is crucial. Ewallet app features like one-click payments, auto-pay options, and real-time confirmations enhance user convenience.

By eliminating delays and complexities, your ewallet app establishes itself as a reliable and user-friendly financial tool, increasing adoption and retention rates.

DeFi Integration

Decentralized Finance (DeFi) integration transforms your digital wallet into a comprehensive financial ecosystem. Users can access advanced financial services like lending, borrowing, staking, and yield farming directly from the app.

This feature of the mobile eWallet app appeals to tech-savvy users who are familiar with blockchain and DeFi platforms, positioning your app as a futuristic solution for managing both traditional and decentralized assets.

Easy Navigation

A well-designed user interface is essential for retaining users. Easy mobile app navigation ensures that your mobile wallet app is intuitive, allowing users to quickly access features like balance checks, transaction history, or fund transfers.

Incorporating a clean layout, categorized menus, and quick-action buttons enhances usability. This focus on simplicity makes your e-wallet app accessible to a broader audience, including non-tech-savvy users.

Integration with Multiple Payment Gateways

Supporting a variety of payment gateways ensures your digital wallet is compatible with different financial systems. Popular options like PayPal, Stripe, or Razorpay expand the app’s utility, providing users with multiple ways to transact securely.

This feature of the eWallet mobile app not only enhances the app’s versatility but also allows for regional customization, catering to local payment preferences and boosting global adoption.

Integration with Partner Brands and Businesses

Collaborating with brands and businesses to offer exclusive deals, cashback, or rewards makes your e-wallet app more appealing. For example, users could earn discounts on purchases when paying through the wallet or receive loyalty points redeemable for services.

Such partnerships drive user engagement, increase transaction volumes, and position your app as a value-packed solution for everyday needs.

Option to Add Multiple Payment Methods

Flexibility is key for users when managing finances through a mobile wallet app. Allowing users to link multiple payment methods—such as credit cards, debit cards, bank accounts, and digital currencies—ensures that your e-wallet app caters to diverse financial preferences.

This feature streamlines payments and eliminates the need for users to rely on multiple platforms for transactions. By providing seamless access to various payment methods, your digital wallet mobile app becomes an all-in-one financial hub.

Integration with Other Apps and Services

Connecting your e-wallet app with external apps and services, such as ride-hailing, food delivery, or e-commerce platforms, significantly enhances its utility. For instance, users can pay directly through the wallet for rides or shopping, eliminating extra steps in the process.

This seamless integration makes the mobile wallet app an essential tool for everyday activities, boosting user retention and positioning your app as a versatile financial solution.

24/7 Support through Live Chat or Call

User trust grows when they know help is always available. By incorporating live chat or call support within your digital wallet, users can resolve queries instantly, ensuring uninterrupted usage.

Features like AI-powered chatbots for initial troubleshooting and human support for complex issues build user confidence. A responsive support system also fosters higher retention and satisfaction rates.

Automated Verification

The onboarding process often determines whether users stay with an app. Automating the KYC (Know Your Customer) process in your e-wallet app accelerates verification while ensuring compliance with regulations.

Users can upload documents, complete verification through AI tools, and access the app within minutes. This feature minimizes friction during onboarding and enhances the overall user experience for your mobile wallet app.

Management of Physical and Virtual Card Operations

Offering users the ability to manage both physical and virtual cards within your digital wallet adds significant value. Users can freeze lost cards, generate virtual cards for online shopping, or set spending limits directly through the app.

This feature ensures security, flexibility, and convenience, making your e-wallet app a central hub for financial management.

Split Bill

Splitting expenses with friends, family, or colleagues can often be cumbersome. A Split Bill feature allows users to divide costs seamlessly within the mobile wallet app.

Whether splitting a dinner bill or shared trip expenses, users can allocate amounts, send reminders, and complete transactions instantly. This practical addition enhances the app’s functionality and appeals to a broader audience.

Loan Origination

Your e-wallet app can become a trusted financial partner by offering quick and easy access to loans. Loan origination features allow users to apply for small loans, track repayments, and manage their credit directly through the app.

By integrating this feature, your digital wallet caters to users seeking fast and convenient financial solutions, boosting engagement and retention.

Chatbots for real-time assistance

All e-wallet users are not tech-savvy and they need assistance anytime, anywhere. That’s where chatbot integration in the e-wallet app will help. The users will be able to connect with the business’s customer support and get the query resolved in real-time. The chatbot feature allows users to ask questions, and report issues, and other things about products/services. Direct and stellar communication results in enhanced user experience and improved user engagement. Such a feature will also help to increase the trustworthiness of online wallet apps and increase user retention rates.

Transaction History and eWallet Passbook

Many times, users want to see their spending to manage their expenditures. That’s where the feature to view previous transactions showcasing past purchases and payments’ history will help. The continuous push notifications when any transaction has been made let the users stay informed about their expenditures. Therefore, you should provide your e-wallet mobile app users the ability to check their e-wallet transaction history. The passbook should classify the payments via bank account and e-wallet separately. Also, every transaction should contain the transaction value, the receiver’s details, the time and date of payment, and additional comments that users might note when making the transaction.

The E-wallet passbook can also be implemented for USSD mobile wallets. The users can access the transactional history through USSD codes on their smartphones.

Wallet-to-Bank and Bank-to-Bank Money Transfers

You should enable your e-wallet users to pay to merchants who don’t account with your e-wallet system. Hence, your e-wallet app should have a feature that enables users to transfer money to the payee’s bank account.

Not every e-wallet user will be willing to add money to their digital wallet, and therefore your e-wallet app should be able to draw money from the user’s bank account and make the payment instantly.

Paypal, Amazon, Cred, PayTM, GPay, and Stripe are among the most popular payment gateways you can use for your e-wallet app. However, you should choose the right payment gateway depending on your geographical market location.

E-wallet app usage is not limited to making payments for purchases. Instead, they facilitate users to transfer money from one E-wallet to another E-wallet or one bank to another bank account. The complete process should be quite easy, simple, and secure to carry out.

Peer-to-Peer (P2P) Payments

Nowadays, paying back to friends or bill splitting has become a very common phenomenon, which is difficult to manage traditionally. The E-wallet app facilitates the same with P2P payments. Such feature allows users to send/receive money to/from through contacts. PayPal is the best example for implementing this feature, which allows users to leverage the wallet for personal and professional purposes hassle-free.

Bill Payments

An e-wallet app must-have more usability than just making P2P money transfers and merchant payments. Modern customers prefer features such as paying mortgages, rents, utility bills, loans, prepaid/postpaid mobile bills, and accessing many other financial services through e-wallets. It becomes possible by partnering with third-party service providers to enable secure and easy payments.

Giving users the option to spend their e-wallet money will encourage them to store and accept money in the mobile wallet app. As a result, the users become loyal to your e-wallet mobile app and also probably will advocate your e-wallet app to others.

Security and Data Integrity

Even though e-wallet apps are getting popular and the number of users are increasing rapidly there are some people who are afraid of using digital wallets because of security concerns. So, security remains the top priority for E-wallet app development. E-wallet mobile app security is a prominent aspect of regulatory compliance and customer acquisition. Take the example of any financial solution; security and data integrity is the foremost concern. Although e-wallets tend to be more secure than debit/credit cards, security concerns remain intact for regulatory compliance.

You can enhance your mobile wallet security by implementing technologies such as multi-factor authentication, tokenization, end-to-end encryption, PIN-generation authentication, etc.

Popular payment gateways like- PayPal, Braintree, and Stripe have enabled robust security features with a powerful authentication mechanism that made their e-wallet system one of the most secure ones. Thereby only authorized users can access and make transactions through the E-wallet app.

Self-Registration

Presently, users are more likely to do things on their own. The DIY concept goes with the registration process too, wherein users are allowed to register following a couple of steps. Users only need to download the application, complete the KYC process, confirm registration, set login ID and password, link bank accounts, and add money.

Personalized Loyalty Rewards and Discounts

Reward points and discount coupons are among the most crucial arsenal for digital marketers of your e-wallet app. E-wallets provide marketers with an ideal environment to market additional financial services to customers with such user-friendly mobile app features. It would help if you built rewards and loyalty programs to encourage users to use the app frequently, which helps to increase app user retention and engagement, with word-of-mouth publicity as an added benefit.

With fierce competition in the market, it’s difficult to make your online wallet app stand out. Here, providing rewards and discounts to your e-wallet app users for using the app increases their interest in the app. This way, user retention rates, and engagements are increased.

Adding a personalized touch to rewards and discounts based on user preferences and spending habits can further enhance engagement. Features like time-limited offers or gamified reward systems can encourage frequent app usage and build long-term customer loyalty.

Expense Tracking and Budgeting

Though there are specialized apps for planning and budgeting, they require users to share their bank accounts and transaction information, scaring users of data theft and misuse.

Integrating planning and budgeting features into your e-wallet app will allow users to optimize their spending. The users don’t have to input any payment information as it will already be available in your database. In fact, this will encourage users to prefer making payments via your digital wallet app. Also, implementing data analytics to this feature will be a wise investment.

A futuristic and reliable e-wallet mobile app should help customers spend wisely. Category-wise budget allocation, bill payment reminders, creation of categories for income and expenses, budget limit alerts, and saving goals are some of the ideas to make this planning and budgeting feature effective.

Advanced analytics tools can further enhance this feature by providing users with insights into spending patterns and forecasting future expenses. Additionally, visual dashboards and real-time alerts for overspending can make the app more intuitive and engaging.

Ready to include top features in your E-wallet app?

E-wallet app development is a time-consuming and expensive endeavor that brings results in the crowded market only when it gains an edge with a set of functionalities. Integrating advanced and user-centric features not only serves the purpose but also establishes a strong USP, ensuring your app stands out in the competitive fintech landscape.

Go through the extensive list of digital wallet features provided here and determine which ones align with your business goals and user needs. A thoughtful selection and seamless integration of these features are key to the success of your mobile Wallet app.

The features discussed here are must-haves for a successful mobile wallet app. However, as the world of online payments evolves, your e-wallet app must remain adaptable by incorporating emerging technologies like AI, IoT, and DeFi to meet user expectations and industry standards.

Avantika Shergil

| Dec 10, 2024

Avantika Shergil

| Dec 10, 2024

Avantika Shergil is a technology enthusiast and thought leader with deep expertise in software development and web technologies. With over 8 years of experience analyzing and evaluating cutting-edge digital solutions, Avantika has a knack for demystifying complex tech trends. Her insights into modern programming frameworks, system architecture, and web innovation have empowered businesses to make informed decisions in the ever-evolving tech landscape. Avantika is passionate about bridging the gap between technology and business strategy, helping businesses build customized software and website, and understand about different tools to leverage effectively for their ventures. Explore her work for a unique perspective on the future of digital innovation.