Quick Summary: Do you want to build a bill-splitting app like Splitwise? It’s the most profitable app idea as the bill-splitting app development market is gaining a lot of attention nowadays. You must have explored how apps like Splitwise work. It’s the most straightforward way to organize group bills for restaurants, households, trips, vacations, and more. Given the surging market trend of e-commerce and mobile payment, bill-splitting apps can make the most of it. But building a bill-splitting app requires a lot of preparations, planning, and guides. This article will help you create the app you need. All you need to do is stay tuned to this article.

Did you know Forbes Advisor and OnePoll surveys find that around 47% of adults in the U.S. split bills for regular purposes, including restaurant meals, groceries, and others, by using peer-to-peer (P2P) payment or bill-splitting apps like Venmo, Zelle, Splitwise, Cash Apps, and others?

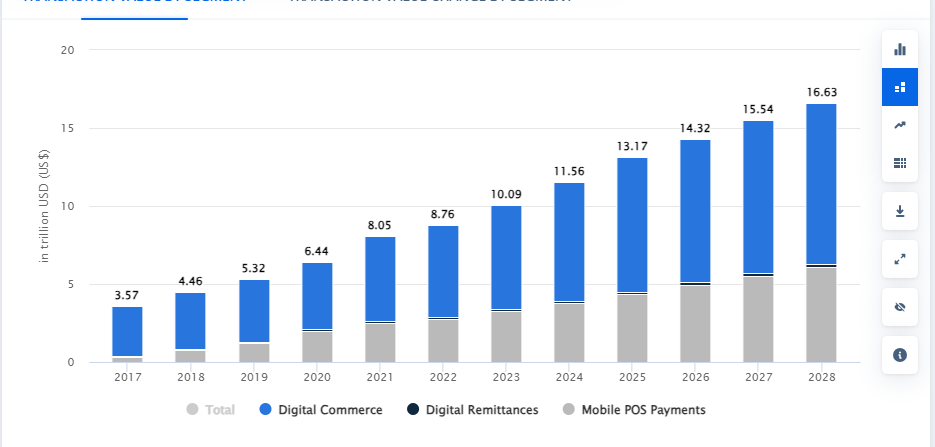

Bill-splitting apps have done a lot to enhance bill-splitting experiences. Gone are the days when one person had to bear the entire bill in case the other party forgot their wallet. While digital payment meters touched 10 trillion transactions in 2023, bill-splitting apps are all new trends that offer the easiest way to split bills among friends while keeping everything fair. Your idea to develop a bill-splitting app like Splitwise is the perfect first step.

Now, you must be trying to find a good mobile app development company to help you build the app. But hold on; you have something more to do before you find a partner for bill split app development. There are various factors you must know so you can, at least, understand what is being done for the app.

In this article, we will discuss a detailed guide to building bill-spilling apps. The points which we will discuss, include;

- What is a Split Bill App?

- How does Bill Split App Work?

- Why Invest in Bill Splitting App Development?

- Why is Building a Bill Splitting App, Like Splitwise, a Good Fintech App Idea?

- Must-Have Features to Include While Developing Bill Splitting App Like Splitwise

- Advanced Features to Consider for Bill Splitting App Development

- Bill Splitting App Development Process: Key Steps to Follow

- How Much Does It Cost to Build a Bill Splitting App?

- Design Tools And Tech Stack Used For Bill Splitting App Development

- Monetization Strategies of Bill-Splitting App like Splitwise

So, before we begin with the guide, let us start with the primary first.

Table of Contents

- Bill Splitting App Market Trends

- What Is a Split Bill App?

- How does Bill Split App Work?

- Top Reasons to Invest in Bill Splitting App Development

- Top Benefits of Bill Splitting App Like a Splitwise

- Must-Have Features to Include While Developing Bill Splitting App Like Splitwise

- Advanced Features to Consider for Bill Splitting App Development

- Bill Splitting App Development Process You Should Know

- How Much Does It Cost to Build a Bill Splitting App?

- Design Tools And Tech Stack Used For Bill Splitting App Development

- Monetization Strategies of Bill-Splitting App like Splitwise

- Where Does TopDevelopers.co Comes in Between?

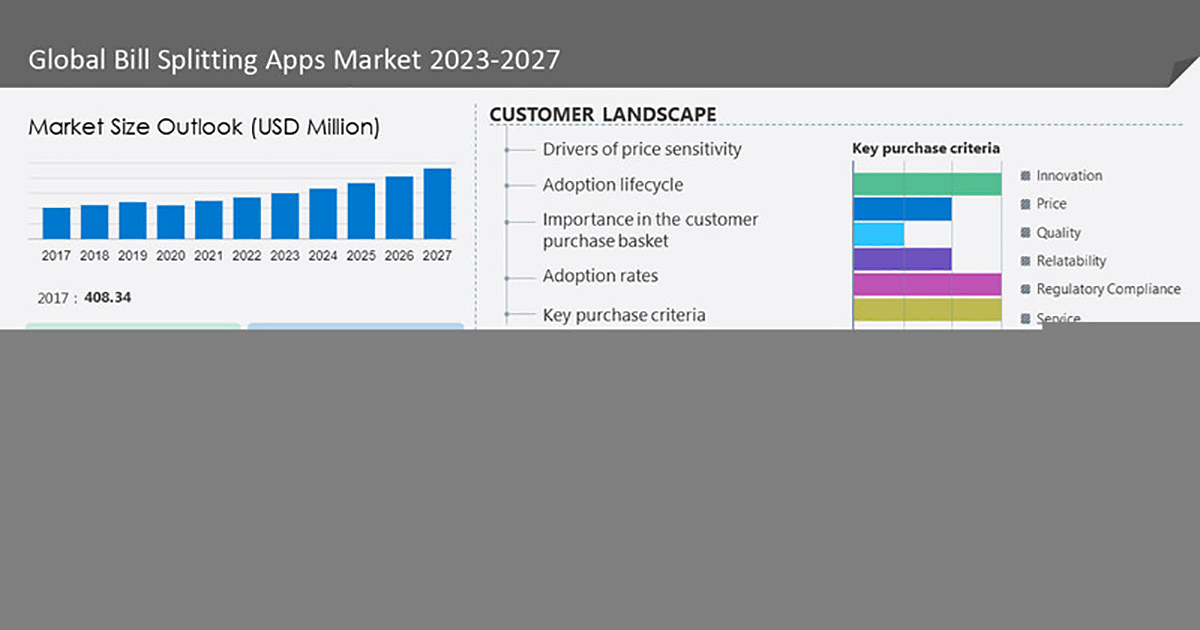

Bill Splitting App Market Trends

We have explored and researched various research platforms and found something interesting to share. Let’s examine the digital payments and bill-splitting app market.

According to a report published on Yahoo Finance, the bill-splitting app market is projected to grow by USD 380.28 million from 2022 to 2027.

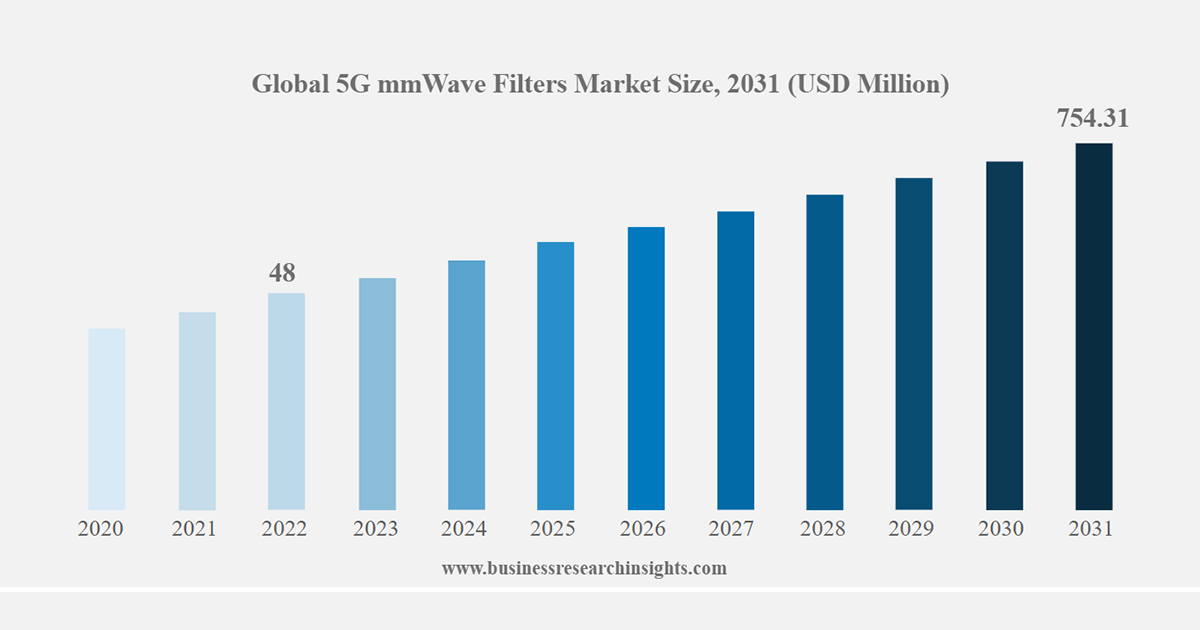

However, if you look at other research portals, they have different opinions regarding the bill-splitting market size. For example, Business Research Insights suggests that bill splitting apps market size will grow by USD 993.02 million by 2031 from USD 500.6 million in 2021 with a 7% CAGR.

What Is a Split Bill App?

Check splitting is not a new terminology; it has been a long-term phenomenon; now, with the boost of digital transformation, new payment apps are making headlines in the tech arena. There are plenty of apps that changing the way people share the bill. Bill splitting is a growing trend among friends and family. Basically, with bill-splitting apps, users can track, manage, and split bills among friends, roommates, and colleagues. Picture this: you are on vacation with a friend and have paid the restaurant bill. Manually, it requires you to calculate, track, administrate, and manage the entire process, while the bill split app can easily do this with a single click. Just let the app know the number of contributors for the bill; it will take care of the rest.

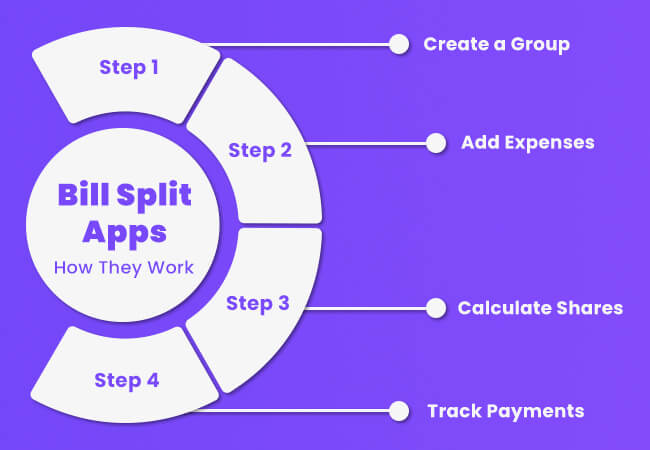

How does Bill Split App Work?

The bill split app works with simple inputs and is designed to automate your manual process. You have four simple steps to follow; the rest will happen automatically. Here’s how the bill split app works.

Step #1: Create a Group

We assume that you have downloaded the best bill-splitting app and have made each member in the group do the same. You can also do this by sending them an invite and getting them to register on the app using their information. In the meantime, you have to create a group and send invites to each member who you want to join the group for bill splitting.

Note: When you register the bill-splitting apps, make sure you have added and authenticated your account with the app.

Step #2: Add Expenses

In the next step, you add expenses, such as the amount you want to split among the group. In some cases, you need to process the payment for the bill you have paid. You can split those payments directly through the app.

Step #3: Calculate Each Person’s Share

When you enter the amount, the app will help you calculate the bill for the mentioned group. The estimated amount is automatically shared among the group members. It can calculate any type of payment made by any member of the group and share it equally.

Step #4: Track Payment – Who has Paid

The next thing the bill splitting app will do is help you track who has paid and if there is anyone who has yet to pay.

Top Reasons to Invest in Bill Splitting App Development

Building a bill-splitting app is an excellent business idea that can help you attract tech-savvy users. Here are the top reasons why you should consider investing in a split bill app.

Growing Demand

The bill-splitting app market is expected to grow $993.02 million by 2031 from the expected US$11.55 trillion digital payment market. The demand for bill-splitting apps is skyrocketing due to urbanization and changing consumer preferences.

Opportunity

As everything is digitized, people will be highly dependent on digital innovation. The bill splitting app, on the other hand, offers significant opportunities for users to track, manage, and split bills without any manual work. Besides, due to growing trends, it is an opportunity for business enthusiasts to grow and innovate.

Profitable FinTech App Idea

Yes, building bill-splitting apps is an excellent FinTech app idea for people exploring profitable businesses to start in 2024 and beyond. While it offers a convenient and secure way for users to settle debts and manage shared finances, businesses can monetize the app and get the most out of it.

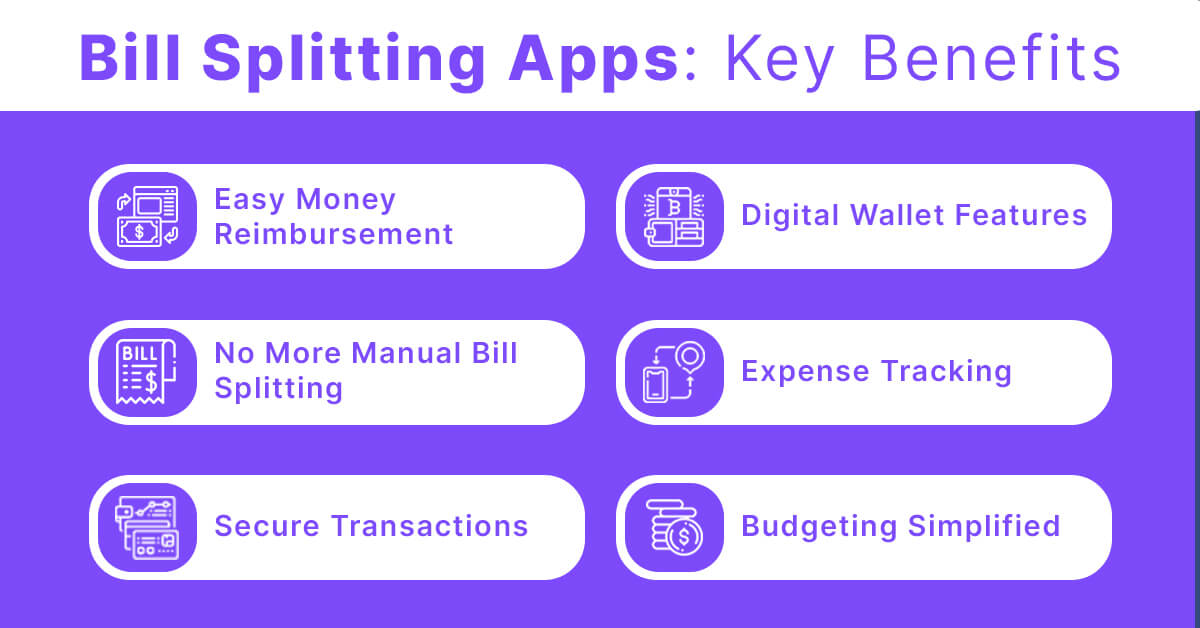

Top Benefits of Bill Splitting App Like a Splitwise

We have already discussed the top factors stating why we should invest in bill-splitting app development, which are excellent FinTech app ideas based on market factors. Now understand why users need a bill-splitting app like Splitwise, from money reimbursement, bill splitting automation, and safe transactions to efficient expense tracking, budgeting, and a secure digital wallet. Let’s explore these points in detail.

Money Reimbursement Made Easy

With a bill-splitting app, reimbursement becomes easy. Users don’t have to keep track of how much they owe and to whom; the split bill app does it all for them.

No More Manual Tracking, Calculating, and Splitting Bills

When you have an app, you do not need to keep track of every bill manually or do not need to spend hours behind bill calculations as the bill-splitting app does it automatically.

Safe Transactions

Bill-splitting apps are powered by secure technologies, ensuring every transaction you make is safe and encrypted.

Digital Wallet

Bill-splitting apps are not just for splitting bills but can also work as a safe digital wallet. You connect your bank accounts with the app, and it handles the rest.

Expense tracking

When you have an app to split bills, you can easily track your expenses for a particular trip, vacations, outings, households, and others.

Budgeting

Some apps can help you budget by providing insights into your expense categories.

Must-Have Features to Include While Developing Bill Splitting App Like Splitwise

When you build apps like Splitwise, they must have the characteristics of applications. Hence, you need to keep the features gap in mind and ensure your bill-splitting app has all the features that Splitwise has and even includes those that the latter lacks. Here are some standard features you should consider while building an app like Splitwise.

User Registration and Authentication

This feature allows you to onboard the app users by registering and authenticating information.

User Profile

In this feature, users create a personal profile that includes their name, address, and contact information.

Account Details

Users can connect accounts with the app for transactions.

Expense Tracking

This feature gives real-time expense tracking to users by streamlining functionalities for recording shared expenses.

Group Management

This feature allows users to manage groups, such as adding new members, removing members, and other rights.

Split Bills

This is the core feature of the app, which lets users calculate and split bills among users.

Settle Balances

This feature in the bill split app allows users to settle balances with each other.

Notification

The notification feature ensures all members are notified in a timely manner and even get information regarding expenses.

Transaction History

Transaction history is a must-have feature in a bill-splitting app, as it provides users with a detailed log of all transactions within a group.

Bill Reminders

This feature automatically sends reminders to all users in the group for pending payments.

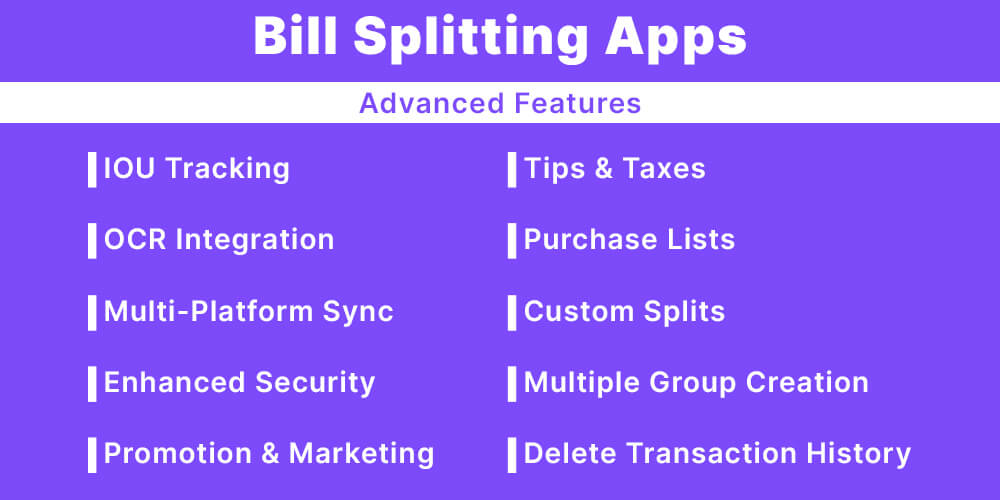

Advanced Features to Consider for Bill Splitting App Development

Advanced features that set the bill split the app apart from others. You must explore mobile app development trends, perform competitor analysis, and research the target market. Based on your findings, you can create some advanced features that would be unique and exclusive to your app. Here are some ideas that you can explore;

IOU (I Owe You) Tracking

This feature enables users to track debts and even send notifications for payment.

OCR Software

Optical Character Recognition is a feature for scanning receipts.

Multi-platform Synchronization

This feature enables users to synchronize data across devices.

Security

Security integration is crucial to ensure all data within the app is safe.

Promotion and Marketing

This feature strategically promotes the app to customers or users by promoting your app and prompting users to download and use the app.

Tips and Taxes

Tip & Tax provides a comprehensive guide on transactions, bill split, and taxes levied on each transaction.

Lists of Purchases

Users can list the purchases by scanning the receipt and even segregating them into categories.

Custom Splits

Based on advanced algorithms, this feature can help users with custom splits.

Multiple Expense Group Creation

This could be a must-have feature, as users will need to create multiple expense groups. The feature will allow them to create as many groups as they need.

Deleting Transaction History

Users can delete unnecessary transactions using these features.

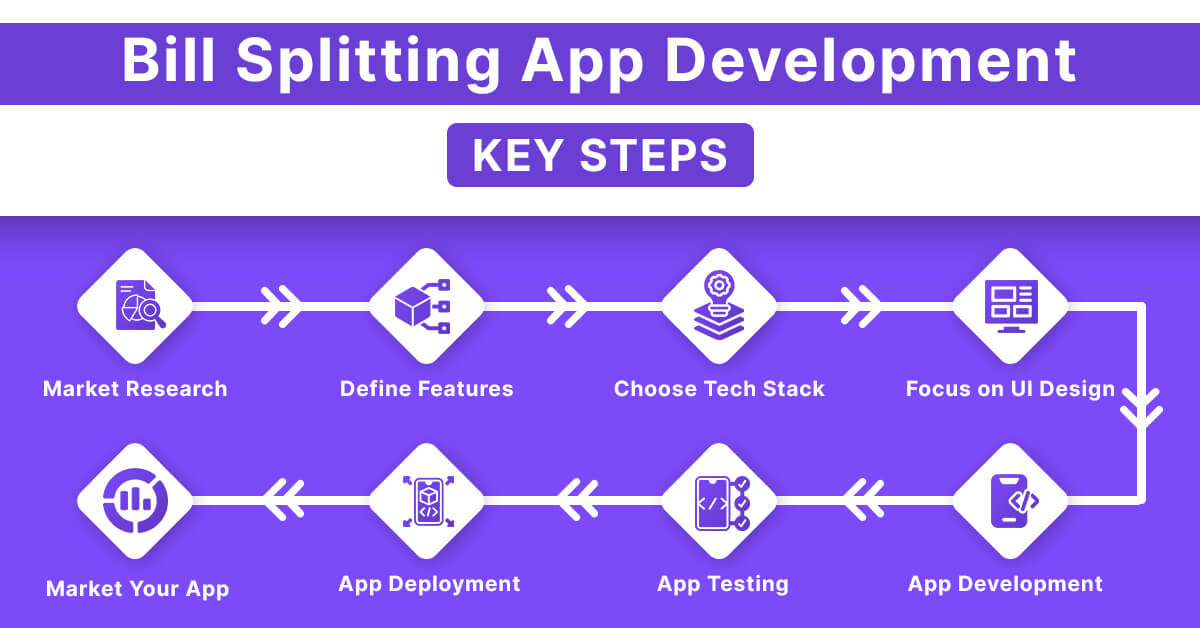

Bill Splitting App Development Process You Should Know

Bill splitting app development is crucial to you; hence, you must know how to build an app for your split bill app business. We have suggested a few steps that can help you understand what process it follows to build a quality bill-splitting calculator app.

Market Research

Market research is crucial as it will help you determine who you are developing this split bill app for. With market research, you can identify your target audiences, analyze competitors, identify pain points, and create effective app development strategies.

Define Features and Functionalities

With market analysis, you know your users, their pain points, and the market gap. Now, you need to create features and functionalities based on your research. We have suggested features for your idea. You can explore more and seek the help of your mobile app development partner for better understanding. Think about the application’s UX carefully and provide unique user experiences.

Decide the Technologies or Tech Stacks

When creating a FinTech application, you need to decide on the technologies. Based on the technologies, you need to partner with app development companies with relevant skills and expertise. For example, if you are using AI, ML, React Native, or Flutter, then you need mobile app development agencies with expertise in AI/ML and hybrid technologies.

Think about UI

In app design, UI is crucial as it gives your users an excellent first impression. It must be visually appealing, so users love to interact with it. With an easy-to-use / onboard, navigate, and simple yet focused design, users can easily connect with your app for longer.

Develop the App

Once it is designed, it will be tested and approved by all stakeholders. Then, your development team will turn those designs into code.

Testing

Now, you need to ensure the app is perfect for launch. App development agencies have a QA team that tests the app on various parameters before they launch it. However, you can reaffirm this by releasing the app to a limited audience for beta testing. You will be able to find the issue (if there’s any) and fix it before the final launch.

Deploy the App

Now, deploy the app on the app stores. For example, if you created the bill split app for iOS users, you need to launch it on the Apple App Store and Google Play Store if you made the app for Android users. Or, if you created the money split app for both platforms, deploy it on both platforms.

Market Your Bill Split App

You have deployed and launched the app, but your users will not know this unless you let them know. You can create effective marketing strategies, such as implementing social media marketing strategies, promoting your apps on third-party websites, creating blogs, and more.

How Much Does It Cost to Build a Bill Splitting App?

The cost to develop a bill-splitting app like Splitwise will be anywhere from $20,000 to $50,000, depending on factors such as the app’s complexity, features, app development partner, location, and the skills and experience of the mobile app development team.

Developing an app that splits bills will be costly if you have complex UI/UX and have a broader perspective to achieve. For example, if you have a standard split bill app to build, it will cost you around US$20K to US$30K. However, if you have complex apps with an n number of features, the cost would increase from $35,000 to $200,000.

You can estimate bill-splitting app development costs by analyzing a few things, such as your project scope, and app development company’s location. For example, if you hire mobile app developers in USA, the hourly rates can be around $80 to $199 per hour. However, if you find an app development company in a South Asian country like India, the development charges would be around $15 to $50 per hour.

Now, you can easily calculate the app costs based on the bill-splitting app’s features, duration, and development region.

Design Tools And Tech Stack Used For Bill Splitting App Development

As technology advances, you get more options, freedom, and flexibility to choose the tech stacks, tools, and methods you desire or the app required. To build bill-splitting apps, you have various options in terms of tools and technologies. Here is the table to guide you to the right tech stacks and design tools; let’s explore.

| Design Tools | Front-end Development | Back-end development | Payment Getaway Tools | Database |

|---|---|---|---|---|

| Adobe XD Figma Sketch |

React.js Angular.js React Native Flutter Vue.js Ionic JavaScript Android Studio Swift Java HTML |

Node.js Laravel Kotlin Django Python Go PHP Ruby |

Braintree Stripe PayPal |

SQL MongoDB |

Apart from these technologies, you can also choose full-stack technologies, such as MERN, MEAN, and others. In case you choose smart integration, technologies like AI/ML and AR/VR are the best options.

Mobile App Technology Stack: How to Select The Key Ingredient For App’s Success?

Monetization Strategies of Bill-Splitting App like Splitwise

As you create your first bill-splitting app, you must have a monetization strategy in place so you can earn money from it and generate ROI. Here are some examples of monetization strategies you can count on.

Advertisement

You can place ads on your apps and get paid for every time users click on the ads.

Paid Membership Plan

You can offer premium features to users on a subscription basis.

Transaction Fee

You can charge for each transaction made through the app.

Merchant Fee

You can partner with merchants to offer promotions and discounts on products.

Selling Users Data (Permission Required)

If you have permission, you can sell users’ data to a third party and get paid.

Partnership

Find similar businesses that partner with them and provide exclusive data to your users.

In-App Purchases

Offer users some pro features so they can pay you if they need to use those features.

Where Does TopDevelopers.co Comes in Between?

We are the top-rated platform, helping businesses find the best development partner for their app development needs. That basically means we help you connect with mobile app development companies to choose the best one to build the best apps for splitting bills. Connect with us if you want to partner with the app development company. We are helping our users with researched guides and providing ideas regarding app development, partnering guides, and more.

Avantika Shergil

| May 16, 2024

Avantika Shergil

| May 16, 2024

Avantika Shergil is a technology enthusiast and thought leader with deep expertise in software development and web technologies. With over 8 years of experience analyzing and evaluating cutting-edge digital solutions, Avantika has a knack for demystifying complex tech trends. Her insights into modern programming frameworks, system architecture, and web innovation have empowered businesses to make informed decisions in the ever-evolving tech landscape. Avantika is passionate about bridging the gap between technology and business strategy, helping businesses build customized software and website, and understand about different tools to leverage effectively for their ventures. Explore her work for a unique perspective on the future of digital innovation.